Card Costs Soar as European Retailers Feel the Heat from Inflation

April 2022 saw inflation hit a record high of 7.5% in the Eurozone - the market caught between ongoing energy crises, slashed economic growth forecasts, and widespread supply chain disruption. But as retailers’ margins are crunched in all directions, is the same true of their payments partners?

April 2022 saw inflation hit a record high of 7.5% [1] in the Eurozone – the market caught between ongoing energy crises, slashed economic growth forecasts [2], and widespread supply chain disruption.

But as retailers’ margins are crunched in all directions, is the same true of their payments partners?

The rising cost of payments acceptance

Today, businesses pay a fee to accept every card payment (known as the Merchant Service Charge). CMSPI estimates that in the last 7 years, increases to the unregulated ‘scheme fee’ component of this fee have amounted to €1.46 billion in additional annual costs for European retailers. In fact, our data suggests that the average fee to accept card payments in Europe is now higher than it was prior to fee regulation in 2015.

The problem isn’t just the cost, but the complexity. Just as retailers felt they’d overcome the worst of implementing Strong Customer Authentication regulation online, March and April saw a change in the way fees for the use of 3D Secure – the global card brands’ chosen technology for SCA compliance – were charged, many shifting from per-item to percentage rates, and with the addition of new fees for services like Address Verification. International fees have been changing too, with online merchants shouldering 5x increases to interchange fees on transactions between the UK and the EEA from October 2021 and April 2022.

These fees shook online and international channels in the wake of the pandemic. And if that weren’t enough, some of the market’s most expensive online payment methods such as Buy Now Pay Later are expected to become more popular as inflation tightens purse strings [3].

Who benefits from inflation?

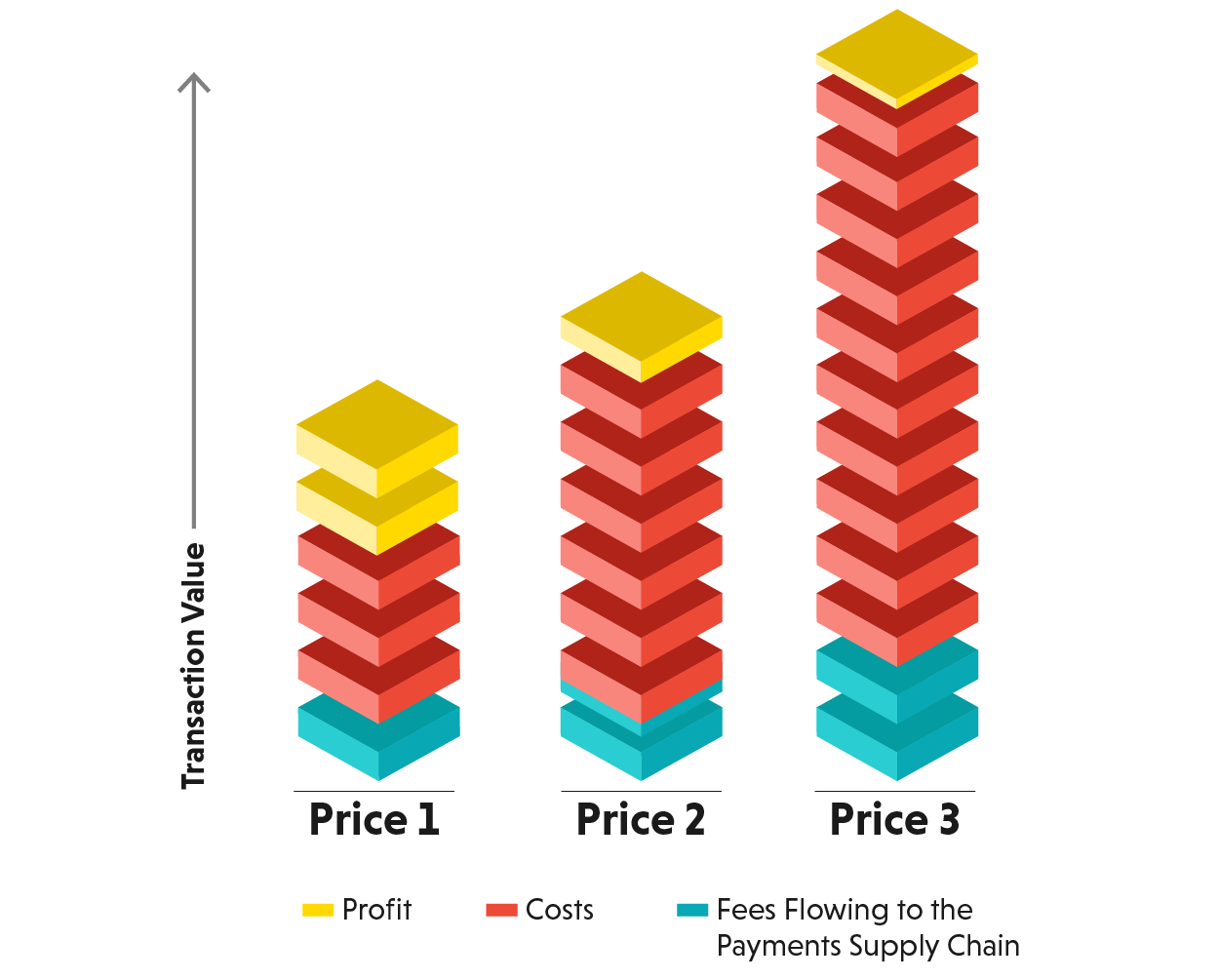

For customers and merchants, inflation can feel like a lose-lose game. But in the arena of card payments, the many percentage-based fees charged to businesses can mean that a higher Average Transaction Value equals greater income for their supply chain (Figure 1). The imbalance already exists; analysis of the major card schemes’ financials reveals profit margins that sit above 50%[4] , compared to figures as low as 1.11% in retail industries like grocery.[5] In fact, one scheme’s CEO was reportedly quoted in their Q2 Earnings Call as saying, “net-net, historically, inflation has been positive for us.”[6] The threat of fees rising in line with inflation therefore makes it imperative that merchants seek to even the playing field with their payments partners.

Keeping customers loyal as inflation soars

Alongside growing transaction charges, the most important cost in payments is losing a good customer. Both forces place often-unquantifiable pressure on retail margins. Merchants are increasingly viewing payments in these terms because it’s not just a sale that hangs in the balance, but a potential lifelong customer.

Analysis suggests that the probability of selling to an existing customer is up to 14 times higher than the probability of selling to a new one. [7] Those repeat customers are 50% more likely to try new products and spend 31% more on average, meaning customer retention rates can have a disproportionate impact on profitability.[8]

This urgent need to gain and retain customers makes it all the more frustrating when payments stand in the way; in Europe in 2021, CMSPI estimates that over €25bn worth of sales was falsely declined at some stage in the payment flow, encouraging loyal customers to shop with competitors that are now just a click away.

How businesses can relieve the pressure

Today, payments can be a merchant’s second-largest cost after labour.[9] As inflation takes hold, retailers are being squeezed in all directions whilst more of their revenue flows to a supply chain that may be performing the same tasks it did before. But that’s not to say there is nothing they can do. Many of the percentage fees merchants pay are considered ‘pass-through’ – leaving retailers with the impression that they are non-negotiable and consistently applied. That’s not always the case; additional opportunities can lie in the pass-through of every part of the Merchant Service Charge – and that’s without considering the errors that CMSPI finds in an estimated 50% of invoices audited.

The same is true of customer loyalty. In 2022, payments remains the often-untapped frontier that determines whether every last sale is successful. But taking advantage of it means data-driven analysis of every element, from the look and feel of a payments page, to the fraud rules of issuing banks that may be excessively declining transactions at the end of the chain. Leaving all these unknowns can mean leaving savings on the table, and unwittingly forcing loyal customers to a competitor. With such intense pressure on retail, the time is now for merchants to optimize their payments when they – and their customers – need it most.

Sources

+-

https://www.cnbc.com/2022/04/29/inflation-latest-eurozone-breaks-another-record-in-april-2022.html

-

https://s29.q4cdn.com/385744025/files/doc_downloads/Visa-Inc_-Fiscal-2021-Annual-Report.pdf

-

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/margin.html

-

https://www.fool.com/earnings/call-transcripts/2022/04/27/visa-v-q2-2022-earnings-call-transcript/