Card-On-File Merchants, Meet Debit Routing: How PINless and Network Tokens Can Impact Cards-On-File

In recent years, card-on-file transactions have become one of the most interesting segments of card not present (CNP) spending.

While traditionally used by gyms, streaming services, and other recurring billing services, the transaction type – which uses a card that a consumer has authorized a merchant to store for future billing – is quickly being adopted by retail.

Historically, COF merchants have had limited access to one of the most important cost-saving tools in U.S. payments: debit routing. But, with near 100% enablement rates of the ‘PINless’ technology expected by 2023, many are wondering: is it high time I took advantage of debit routing? Or does the tokenization trade-off stop the business case from stacking up?

Online Debit Routing: What’s Changed?

In the Fed’s October release, merchants were given one of the biggest wins since the implementation of the Durbin amendment in 2011: PINless enablement is expected to reach near 100% by July 2023.1 PINless technology gives merchants a choice of debit networks for online checkouts – an opportunity which was, until now, largely focused on in-store PIN debit transactions. Full competition between networks for online transactions is estimated to deliver $3 billion in annual merchant savings.

Despite networks offering PINless technology, the Fed found that “some issuers are not enabling two unaffiliated networks to process card-not-present transactions”2 and as a result, merchants have been constrained in their ability to achieve meaningful savings via CNP debit routing. With merchants only able to access PINless networks on some cards, the clarification aims to ensure PINless access on all cards by July 2023, which means near-full access to debit routing for COF merchants.

Card-on-File: The Future of Ecommerce?

In a recent U.S. research study, 48% of consumers mentioned that they save their card information on websites/apps for shopping.3 In Canada, an analysis of VisaNet data identified that 90 per cent of all Visa credit cards that had at least one transaction in the past year were used for a COF transaction, and in fact credit COF users spend 2.4x higher than average credit spenders.⁴

The same holds true in debit. In a 2020 Visa study, they found that as debit customers saved their card information with more merchants, the average number of COF transactions per year increased along with overall spend (Figure 1).

Figure 1. Higher Spending on Debit Card on File5

Despite historic routing limitations, some merchants have found that COF is worth the sacrifice in routing rights given the frictionless customer experience, the average higher levels of spend, and merchant control over the consumer’s payment methods. Now, with the Fed’s recent clarification, there’s a path forward for COF merchants who want to retain their control and consumer-centric checkouts while generating significant cost savings through debit routing.

The Tokenization Question Remains

Even as enablement rates reach 100%, another tradeoff looms: network tokenization. While attractive tools for COF merchants, these solutions have been observed to limit or completely restrict merchant access to debit routing.

Benefits of Network Tokens

A solution which offers authorization uplift and Account Updater tools which can significantly benefit card-on-file merchants, network tokens are tools offered by card networks to limit merchant exposure to consumer card information. According to research by Visa, since implementing network tokens, the average merchant has seen:

- 1% average improvement in authorization rates

- 26% average reductions in fraud rates

In addition, given that 35% of consumers say they have forgotten to update their card information with at least one merchant⁶, the Account Updater functions have made network tokens a hot topic for COF merchants in particular.

Network Tokens and Routing

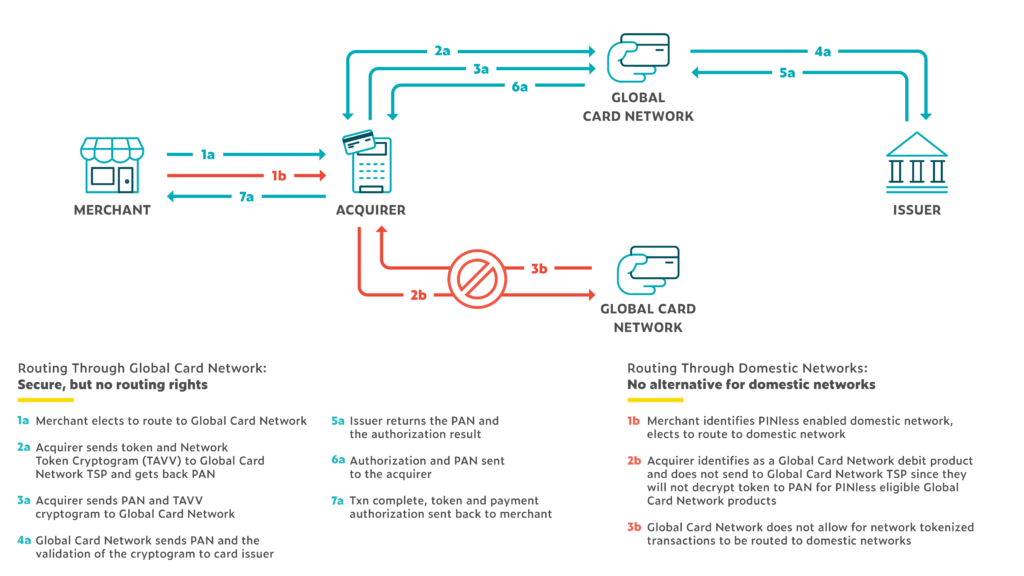

That all sounds great, but both global network solutions make it challenging if not near impossible to route network tokenized transactions to domestic networks (Figure 2).7 According to the Debit Network Alliance, “Mastercard prohibits routing of card-on-file tokens to unaffiliated debit networks” and “Visa allows card-on-file tokens routing to unaffiliated debit networks, but without access to security features such as cryptogram validation and token domain control restriction enforcement.”8

The Future of Card on File

The Fed’s CNP debit clarification laid the groundwork for the FTC to step in to investigate global networks limiting routing rights through the use of network tokens. And that’s exactly what they did – in October, it was reported that the FTC was investigating token restrictions on CNP debit routing via the global card brands.⁹ While no details have been shared yet, the Fed’s language makes it clear that any network rules or practices that inhibit routing would be found non-compliant.

So, what next? Network tokenization or not, merchants developing or already using COF transactions should be preparing to take advantage of the PINless routing opportunity, working with their acquirer on current enablement rates as well as network capabilities by channel and transaction size. When the FTC investigation wraps up, we’ll have a clearer idea of where network tokens stand in the mix, but for now, it is crucial that merchants are ready in time for July 2023.

Sources:

+- https://www.federalreserve.gov/newsevents/pressreleases/files/bcreg20221003a2.pdf

- Ibid

- Visa Research Study, Driving Engagement with Increasingly Digital Consumers, Oct 200

- https://navigate.visa.com/na/spending-insights/seven-ways-to-use-card-on-file-to-reach-top-of-digital-wallet/

- https://navigate.visa.com/na/spending-insights/seven-ways-to-use-card-on-file-to-reach-top-of-digital-wallet/

- https://navigate.visa.com/na/money-movement/why-2021-is-set-to-be-the-year-of-the-token/

- https://www.federalreserve.gov/regreform/rr-commpublic/dna-meeting-20201014.pdf

- Ibid

- https://www.reuters.com/business/finance/visa-mastercard-under-fresh-ftc-investigation-over-debit-card-routing-wsj-2022-10-17/