IFR in Review: The Success and Limitations of Europe’s Most Important Payments Regulation

Lower prices for everyone: this was the stated intention of Interchange Fee Regulation (IFR) when it was introduced back in 2015. For the merchant community, the regulation was a huge step forward in fostering competition in the payments industry – and many have benefited from significantly reduced interchange fees.

But 4 years on, how much benefit are merchants really receiving? With scheme fees continuing to rise and cards outside of the regulation – such as commercial cards – growing in volume, the impacts of the IFR are more complex than they may seem.

Following the recent publication of the European Commission’s review of the regulation, in which Ernst & Young (EY) and Copenhagen Economics conducted an in-depth study into the impacts of the regulation, CMSPI takes a close look at the successes of both the study and the regulation itself: evaluating what improvements merchants have seen in recent years, and what we still need to see changed.

A 400 Word History of the IFR

When processing card payments, merchants pay a number of fees to their acquiring bank – collectively known as the Merchant Service Charge (MSC). The largest component of these charges is typically the interchange fee, which is set by the networks (ie. Visa and Mastercard); charged by the acquirers; and passed through to the issuing banks.

Prior to 2015, these interchange fees were extremely high, with the weighted average level of interchange across Europe standing at around 0.65% for debit and credit card transactions. After years of lobbying and campaigning from merchants and advocates, in June 2015 the European Parliament enacted Regulation (EU) 2015/751.

What Were the Interchange Caps for Merchants?

More commonly known as Interchange Fee Regulation (IFR), the regulation sought to improve competition within the card payments landscape – effectively reducing costs for merchants – by introducing caps on the level of interchange paid to issuing banks. Capping interchange fees at 0.2% for debit card transactions and 0.3% for credit cards, the regulation aimed to bring significant savings to merchants across Europe: in this respect, the European Commission should be commended for their efforts to reduce merchants’ cost of accepting card payments.

In a bid to improve competition within the card payments landscape, the IFR introduced caps on the level of interchange paid to issuing banks of 0.2% on consumer debit cards and 0.3% on consumer credit cards. Other card types were excluded from the Regulation. These caps on consumer cards were intended to bring significant savings to merchants across Europe especially given that the weighted average level of interchange fees across Europe for debit and credit card transactions was around 0.65% before the regulation came into effect. In this respect, the European Commission should be commended in their efforts to significantly reduce the costs merchants face in accepting card payments.

What’s the Significance of Article 17?

The IFR regulation also included a review clause (article 17) requiring the European Commission to submit a report to the European Parliament and Council as to the overall effectiveness of the IFR. In 2018 the European Commission engaged the services of Ernst & Young (EY) and Copenhagen Economics to undertake a study with the objective of collecting and analyzing key qualitative and quantitative market information from all Member States for the period 2015-2017. The EY/CE final report on the application of the IFR has just been published.

Our Insights

CMSPI has reviewed the document and outlined 7 thoughts on the final report below, building on a comprehensive report from EuroCommerce (European trade association) and specialist economics advisory firm Zephyre. Ernst and Young and Copenhagen Economics faced a significant challenge in producing the review document and should be commended for the quality of the report produced given the inherent difficulties involved in its production.

1. ‘Surveying; A Challenging Methodology’

The bulk of the analysis carried out under the review relied on survey data which is problematic for several reasons including the difficulty in getting a significant enough response rate from merchants and the reliability of the data provided in responses received. To mitigate concerns surrounding survey data, one would expect a large sample size, however, the response rate was particularly low with only 270 merchant replies from an initial list of 4,098, reducing the valid sample size used in the analysis. Furthermore, the limited two-year time horizon for the review and the advance notice given, meant that schemes could delay significant increases to scheme fees in the knowledge that such increases would not be reflected in the period of the review.

Additionally, the key analysis required for this review should have been conducted on acquirer invoices sent to merchants rather than surveying: only then could robust and accurate figures be calculated for each of the key cost areas of interchange, scheme fees and acquirer margin.

2. ‘How Much Did the IFR Really Benefit Merchants?’

Prior to adopting the Interchange Fee Regulation, the European Commission put forward an impact study estimating potential savings as a result of the proposed caps to be around 6 billion Euros, like CMSPI estimates. This EY study estimates significantly lower savings of around 2.7bn EUR. By selecting 2015 as the base year to compare interchange fee reductions to, the report underestimates the size of the savings.

The report could have been more clear in terms of which reductions in interchange fees were specifically due to the IFR, in contrast to previous regulatory actions and commitments from Visa and Mastercard. Without these, interchange would certainly have been much higher than the base year 2015 level.

Visa Cross Border Interchange Program (V-CBDIP)

Visa introduced the Cross Border Domestic Interchange Program (CBDIP) as early as January 2015 allowing some merchants to benefit from the capped level of interchange for domestic transactions. A significant number of merchants, therefore, will have benefitted from the interchange fee regulation during this period of time, which the current methodology fails to take account of. The study acknowledges that their estimate of the average interchange rate for 2015 is significantly lower than several public sources as well as the level of interchange fees for member states in 2013 reported by the European Commission.

3. ‘Scheme Fees; A €800m Hole In The Study’

One of the major concerns for merchants was that scheme fees, among others, were not included in the regulation, leaving scope for the card schemes to capture the savings benefits through introducing higher fees. The report estimates an increase in acquirer scheme fees of 280m EUR within the review period which falls slightly below CMSPI estimates of around 340m EUR.

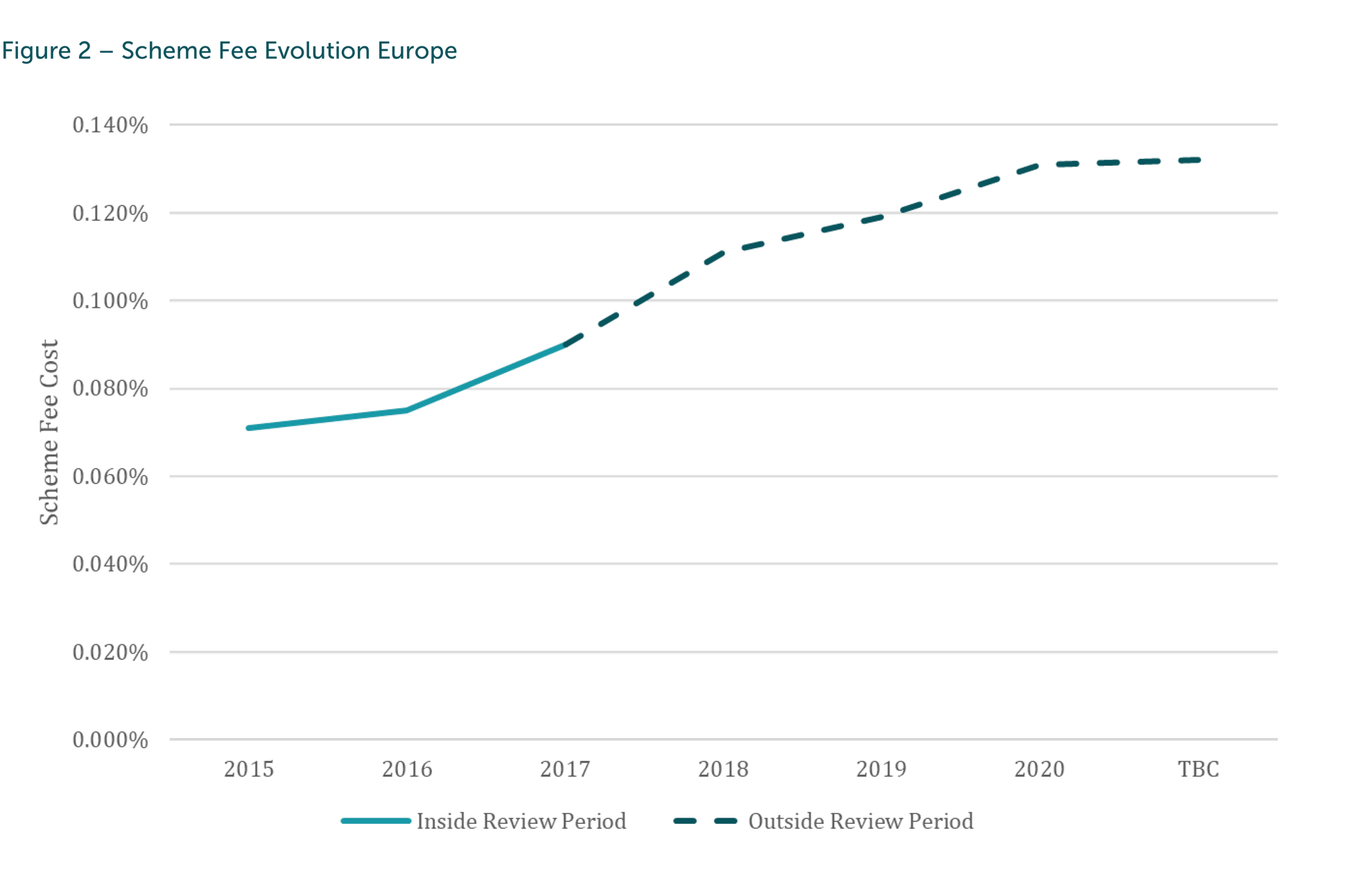

However, the majority of scheme fee increases which have taken place, have been introduced outside the review period – with CMSPI estimating increases in scheme fees of around €791 million. Out of the 10 scheme fee increases announced since 2015, only two fall within the review period (Figures 1 & 2).

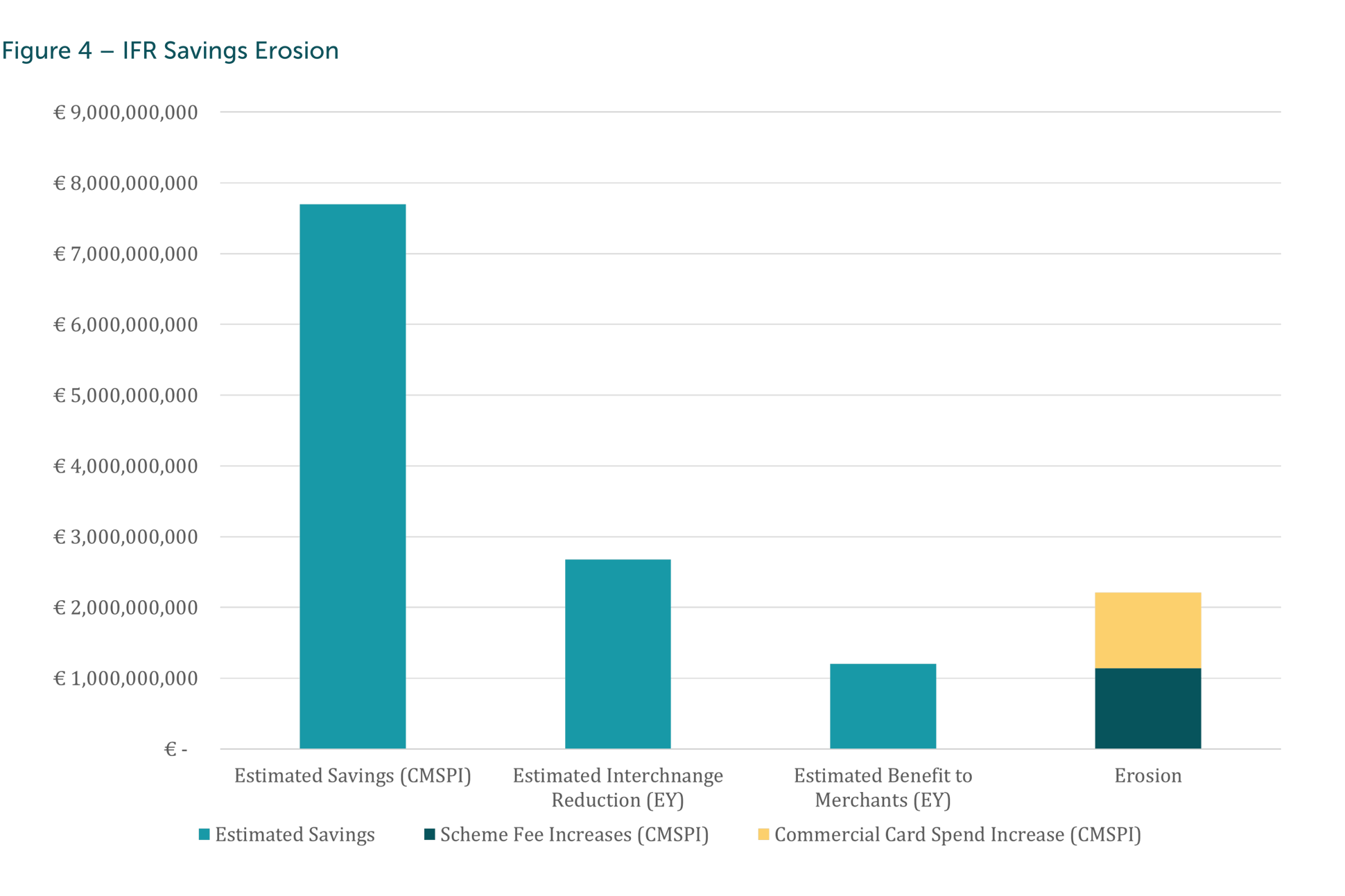

These combined scheme fee increases both within and outside the review period are estimated to cost European merchants an additional €1.13Bn EUR which, if the interchange savings estimates of the EY report are correct, amounts to almost half of the savings introduced by the IFR being lost.

Statistical Issues

The report concludes that there is no statistically significant relationship between the IFR and acquirer scheme fee increases, however the method employed to estimate this is not the most convincing. The rationale behind the model is that if the card schemes were looking to capture the benefit of reduced interchange fees, scheme fee increases would be greater in countries which had a greater reduction in their levels of interchange. They define the treatment group as those with a substantial reduction in interchange and the control group as those member states with a modest reduction in interchange fees. They do not find a statistically significant relationship between the size of the interchange fee reduction and the change in acquirer scheme fees. The sample size for this regression is only marginally above 100 making it very difficult to achieve statistical significance and the methodology used does not rule out blanket increases across countries. That scheme fees have been increasing overall is the issue not the differential increases between member states.

4. ‘Spend on Unregulated Cards Continues to Increase’

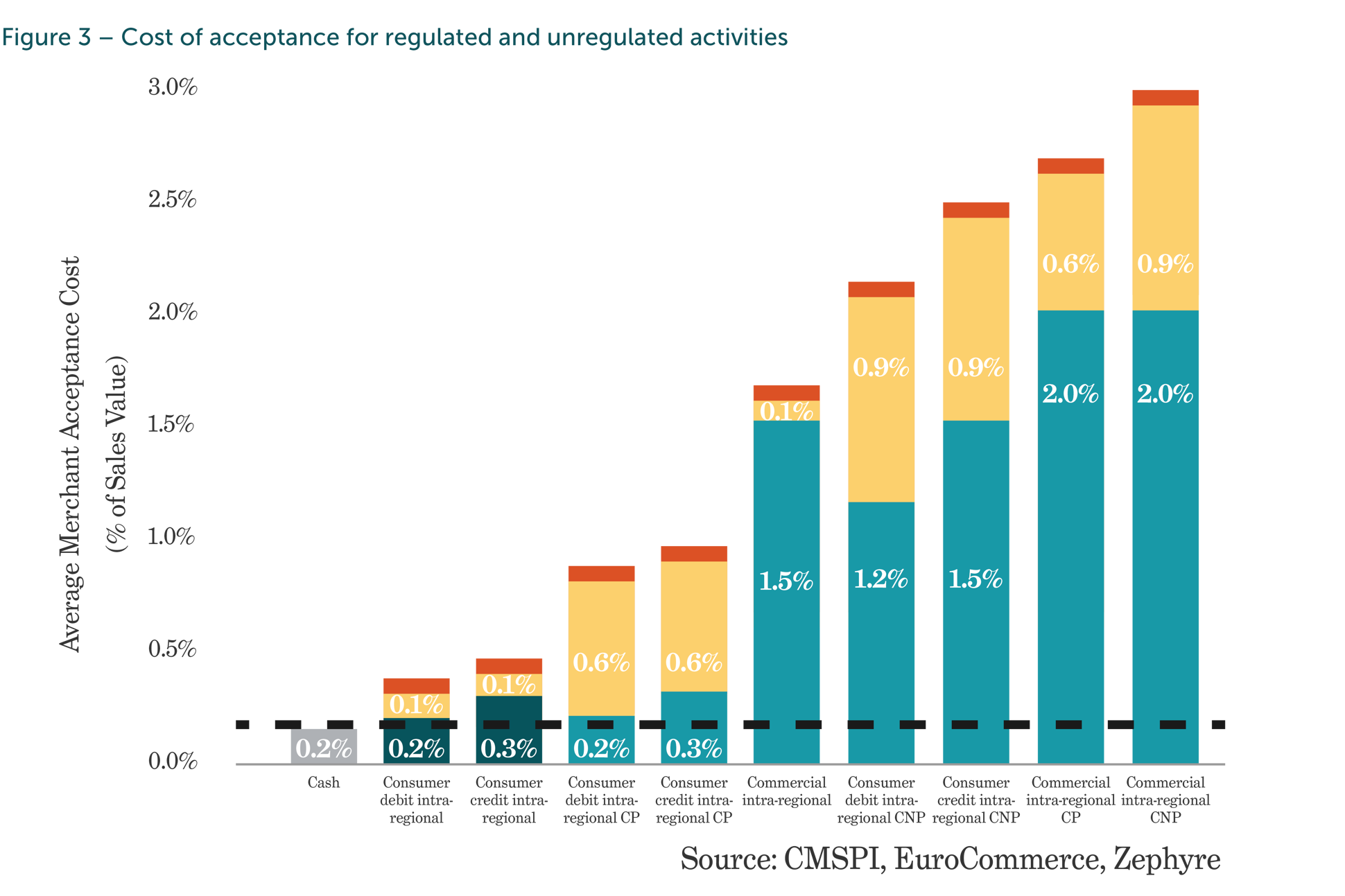

The EY report highlights a significant increase (12%) in the number of commercial card transactions. Although the report does not illustrate a significant increase in the interchange associated with commercial card spend, this is beyond the point as far as merchants are concerned. The cost of accepting commercial cards is significantly higher and issuers obtain a higher level of interchange from commercial cards. Although the interchange fee associated with commercial cards may not have increased, higher commercial card usage increases the cost of acceptance for merchants. Figure 3 illustrates the difference in the cost of acceptance of different card products. As illustrated, the cost of accepting commercial cards can be thrice as much as accepting consumer cards. As commercial card spend continues to rise, merchants will inevitably see increases in the cost of accepting payments eroding more of the savings introduced by the IFR over time (figure 4). Therefore, interchange on commercial cards should also be brought within the scope of the regulation and capped. CMSPI estimates capping commercial card interchange will save European merchants a further €3.43 Bn Euros annually.

5. Do Card Fees Impact Consumer Costs?

The EY report estimates an approximate pass through of 66% of cost decreases to customers. Using these pass-through rates, the report estimates consumer savings of €587M EUR as a result of lower interchange rates. The Shapiro study in the US found a similar cost pass-through rate of 69% illustrating that regulation in the card acceptance space benefits both merchants and consumers.

6. Competition in the three-party card space

3 party card schemes such as American Express were exempt from the IFR regulation . Given that the acquirer, issuer and scheme are, in most cases, the same entity for 3-party scheme cards, there is a lack of real competitive pressure in reducing the cost of accepting these cards. 3-party schemes should be mandated to license the acquiring of their cards to independent acquirers. This would effectively mean merchants could choose from a variety of acquirers when looking to accept 3-party cards just as they can with normal card products creating downward pressure on the acquirer portion of the MSC. Given that the issuer and the acquirer would no longer be the same entity, 3-party cards would also fall under the IFR regulation reducing the interchange portion of the MSC.

7. Complexity Suits the Supply Chain – Acquirer Fees

The report highlights concern surrounding the degree to which acquirers have absorbed savings from the IFR. Out of the €2.7Bn EUR savings, acquirers are estimated to have seen an increase in revenue of around €1.2Bn EUR whilst merchants are estimated to have seen a reduction in their MSC of 1.2 bn EUR. These numbers suggest an acquirer absorption rate of almost 50% of the intended savings for merchants and consumers. Given that acquirers insist scheme fees are pass-through fees, it would seem that acquirers are passing on cost increases in full but withholding some of the cost savings – highlighting the need for greater transparency and competition in the card acquiring space

Conclusion and Recommendations

The Interchange Fee Regulation marked a huge step forwards in reducing the cost of acceptance merchants face in the card payments landscape and introducing greater transparency to the European payments market. The review of the IFR, although limited due its small sample size and narrow review window, illustrates interchange fee regulation benefitted both merchants and consumers. However, a significant portion of intended savings for merchants have been absorbed by acquirers or eroded by scheme fees (figure 4) whilst unregulated card spend continues to increase the costs for merchants. The issue of excessive cost in the payments market is far from over and CMSPI believes the following actions need to be taken;

- The total Merchant Service Charge should be capped to tackle rising scheme fees and acquirer absorption of interchange savings.

- Commercial Cards should be included in this.

- 3-party schemes should be mandated to license the acquiring of their cards to independent third-party acquirers.

- A periodic review of any future card fee regulation.

“In an ideal world, we’d see not just domestic competition but pan-European competition. Fee capping was great, but it’s a game of whack-a-mole.”

Robbie MacDiarmid, Senior Economist