Australian Businesses Could Be Losing Millions to Errors on Card Acceptance Invoices

Australian merchants paid an estimated $5 billion just in card fees this year¹. Merchants often think they need to switch payment partners to drive savings, but many are finding that the complexity of their current arrangements is already leaving millions on the table.

The Hidden Impact of Card Fees

Every time a customer buys a product or service by card, the merchant pays a merchant service fee (MSF) to accept this card. These fees, often an assortment of percentage and per-item fees, can seem small when compared to the total value of a sale but can balloon into a greater expense when applied to every single card transaction. In 2022, CMSPI estimated that Australian merchants paid around $5 billion in card fees,2 in many cases making them the second most expensive operating cost for merchants after labour.3

With inflation and interest rates still at an all-time high in Australia⁴ and a looming economic recession,5 MSFs can seriously cut into the overall profit margin of a merchant and serve as the make-or-break for many.

Merchants assume that these fees are always pass-through correctly through the supply chain, but when these fees differ significantly between acquirers and payment structures, merchants often lack visibility over the true underlying rate. Since fees are so complex, it’s hard for even payment partners to pass them through on a mass scale correctly. In fact, for an estimated 1 out of every 2 invoices, CMSPI finds substantial mischarges,6 potentially saving merchants millions of dollars with an invoice audit.

What are MSFs?

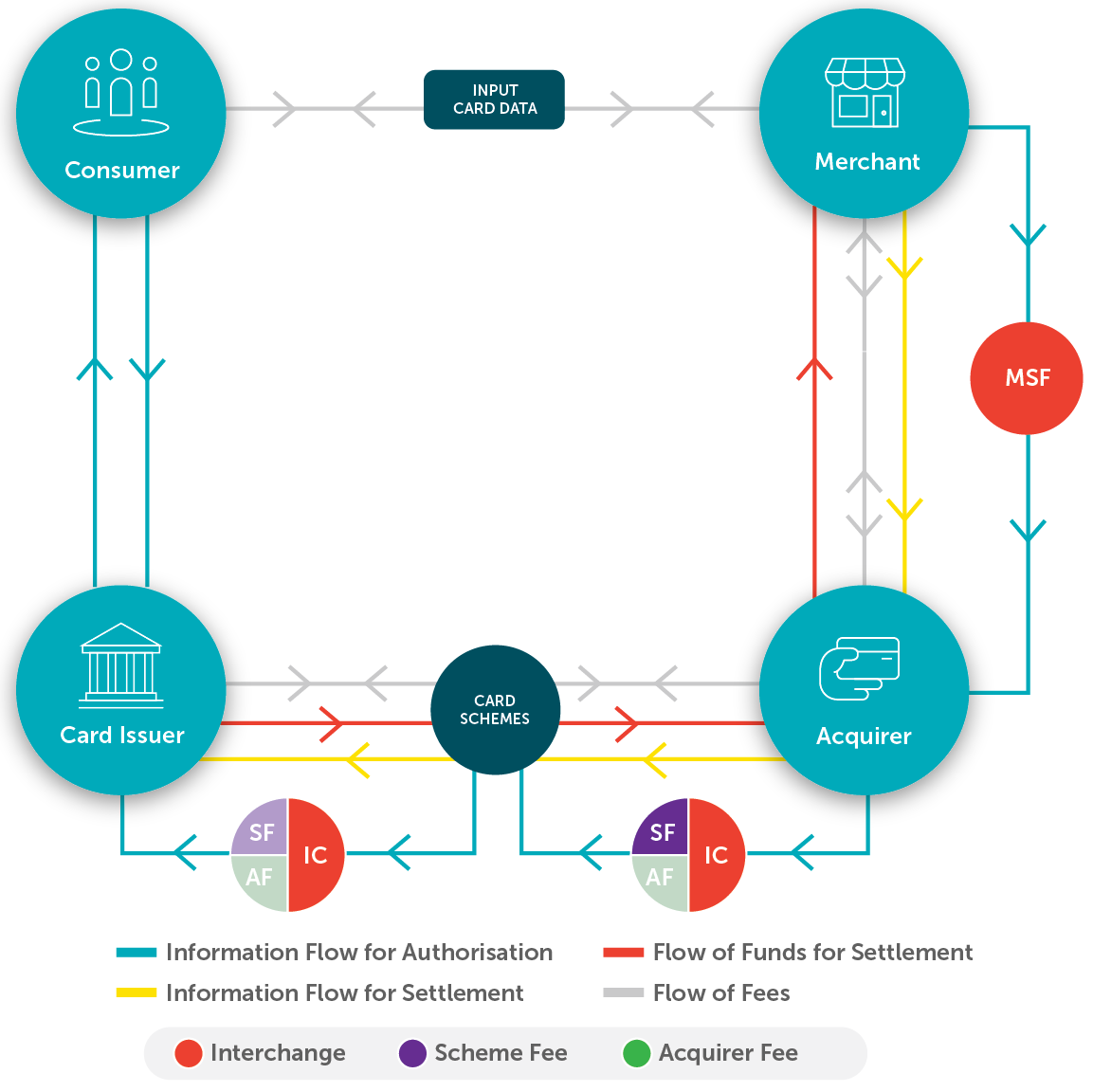

Merchant Service Fees (MSFs) are a mixture of three main components:

- Interchange fees that go to the cardholder’s issuer;

- Scheme fees that go to the routed scheme; and

- Acquirer fees that go to the merchant’s acquirer

These fees often correlate with volume and are made up of hundreds of individual fees for different kinds of card types, point-of-sale interactions, and additional processing services.

Figure 1. Merchant Service Fee Flow Chart

Interchange fees take up the largest percentage of this cost, making up on average around 70% of the total fee. Although interchange fees are ultimately paid to the cardholder’s issuer, the schemes set the cost of interchange on behalf of the issuers. The merchant receives these fees through its acquiring partner, who distributes the costs within the payments supply chain, as seen in Figure 1. However, since these costs are charged on a per-transaction basis, there are often discrepancies in the pass-through during this distribution.

Merchant Service Fees Are Complex

Figure 2. Varying Pricing Structures

Depending on a merchant’s setup with their acquirer, the merchant could have varied visibility over these individual costs (Figure 2). Blended structures provide the least amount of visibility for merchants, who only see a single, bundled rate per card type. With an interchange+/interchange++ pricing structure, there is often more visibility of these three main components. However, even for merchants that do have interchange++ pricing, there can still be a lack of transparency over what is being included and charged when hundreds of fees are applied across billions of transactions in each sub-category. Figure 3 shows a snippet of just a few interchange fees that can be listed on a scheme website.

Figure 3. IC Fees Listed on Schemes Websites7,8

The Origin of Invoice Errors

Because of the complexity of card fees, varying pricing structures, and multiple parties involved, these invoices can often be riddled with errors. Figure 3 highlights the seven key types of errors that occur in merchant invoices. In some cases, merchants can be subject to “misapplied rates”, meaning that fees for other payment types, channels, or transaction values have been incorrectly applied to volume. In other cases, a fractional fee has been rounded up, resulting in a substantial overcharge, particularly for merchants that have large card volumes. These errors may be small per transaction but can add up to considerable budget increases when applied to every transaction.

Figure 4. The Seven Kinds of Invoice Errors

To learn more about the different fee errors, check out our article on card fees here.

What Can Merchants Do?

Because of the complexity of these fees and the sheer volume of data involved, without the necessary industry knowledge and oversight, conducting an invoice audit can become a very complicated undertaking for merchants. But with visibility over industry benchmarks and experience, these audits can not only provide immediate rebates for merchants but also expose significant opportunities for negotiation in future contracts.

From rigorous auditing and industry comparison under its engagement with CMSPI, one large enterprise retailer discovered several misapplied rates on some credit and debit interchange fees, fees that no other retailer in the same industry were paying. The resulting 10% overcharge entitled the merchant to a six-figure rebate as well as savings from the corrected rates ongoing, identifying millions in savings on the table within its current arrangement.

With the pressures on the economy and card fees continuing to become more complex, the time is now to look at how much you’re being charged for payment acceptance.

Sources:

+- CMSPI Estimates and Analysis.

- CMSPI Estimates and Analysis.

- https://www.convenience.org/Media/Daily/2022/Sep/14/1-1700-Merchants-Call-on-Congress-Swipe-Fee_GR

- https://www.reuters.com/business/retail-consumer/australia-monthly-inflation-slows-october-hints-possible-peak-2022-11-30/#:~:text=Data%20from%20the%20Australian%20Bureau,slowing%20from%207.3%25%20in%20September.

- https://www.smh.com.au/politics/federal/freedom-christmas-has-people-spending-but-the-hangover-is-coming-next-year-20221202-p5c349.html

- CMSPI Estimates and Analysis.

- https://www.visa.com.au/about-visa/interchange.html

- https://www.mastercard.com.au/en-au/business/overview/support/interchange.html