Australian Interchange Changes 2022: A Win or a Loss for Australian Merchants?

In 2022, Australian retail card fees are changing again in compliance with the RBA’s new interchange regulation.

With inflation on an unprecedented rise, companies around the globe continue to experience significant constraints on costs with business pressures at an all time high. And, with domestic merchants paying an estimated AUD 4 billion in payment fees this past year (~USD 2.8 billion), Australia is certainly no exception.

After merchants in Australia called for consolation from high card fees, their pleas seemed to be answered when the Reserve Bank of Australia decreased its cap on fixed debit interchange rates earlier this year (2022).

At first glance, many merchants seem to view this modification as the miracle they’ve been waiting for.

But, is that realistic? Will all Australian merchants benefit equally from this update?

Let’s find out.

But first, here’s a quick refresher.

What are Interchange Fees?

To process in-store or online transactions, all merchants are required to pay a merchant service fee.

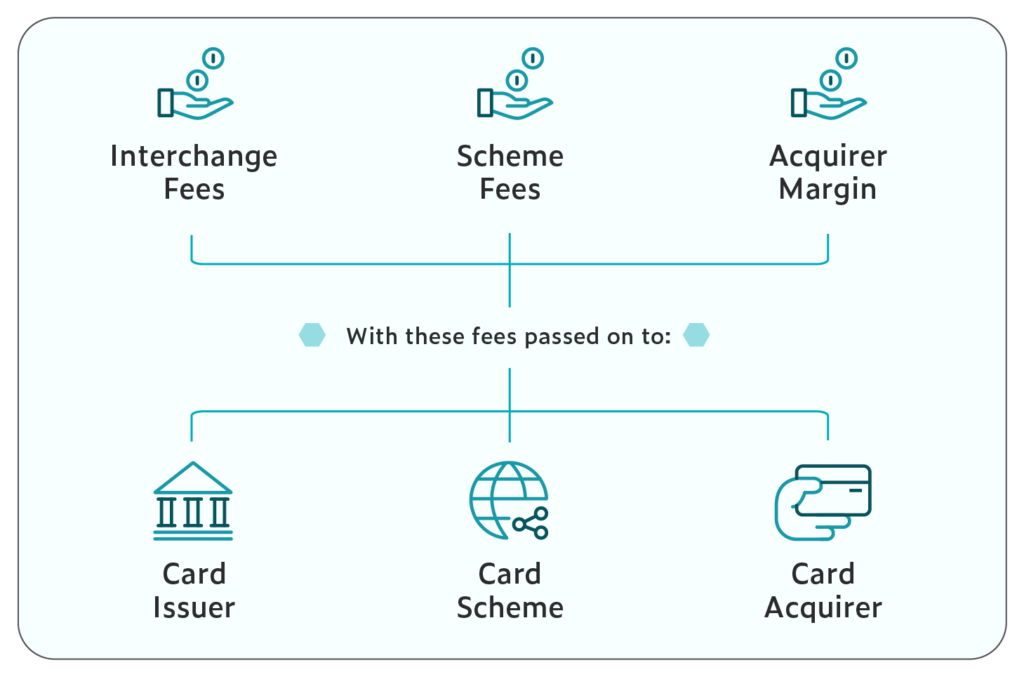

Merchant service fees are charges that can be split into the following categories:

- Interchange fees go to the card-issuing bank

- Scheme fees go to the card issuer

- Acquirer fees go to the merchant processor

Although interchange fees are paid by a cardholder’s bank, the routed scheme on a card, such as Visa or Mastercard, sets both the interchange and scheme fee rates that apply.

Since interchange fees are often the majority of the card processing fees paid by the merchant, shifts in interchange rates can have a substantial impact on the overall costs a merchant pays annually.

Figure 1 – Breakdown of Merchant Service Fees

Reserve Bank of Australia: How it Helps with the Cap

To help alleviate this burden for merchants, the Reserve Bank of Australia (RBA) regularly reviews the cost and impact of interchange rates to determine whether additional regulatory pressure needs to be applied to the market.

As part of the RBA’s review of retail payments last year (2021), the cap for debit and prepaid fixed rate interchange ($) was reduced from $0.15 to $0.10, effective February 1st, 2022.¹

For debit and prepaid interchange rates that are percentage-based (%), the cap remains at 0.20%.

Table 1 – RBA Debit/Prepaid Interchange Caps²

In response to the new interchange cap, the schemes have amended the following rates in compliance with regulation. Some of these rates have been reduced at or below the new $0.10 cap, while others have been switched to the percentage-based cap of 0.20%.

Table 2—February 2022 Interchange Changes – Visa³

Table 3 – February 2022 Interchange Changes – Mastercard⁴

Table 4 – February 2022 Interchange Changes: eftpos⁵

Benefits for Australian Merchants

At the end of the day and in the simplest terms, merchant costs decrease as interchange rates decrease.

Overall, these interchange revisions are a small win for the merchant community, adding up to an estimated $22 million in annual savings across the retail industry.

However, these results can vary dramatically depending on each individual merchant’s profile.

Industry Savings from Interchange Changes⁶

Potential Cons

For merchants with high ATVs over $75, the move from a fixed fee to a percentage fee for Visa CP Tokenised and Mastercard CNP Standard could result in a net increase in costs, since the cost of these percentage fees will increase along with the transaction value.

Unlike percentage-based fees, fixed fees will stay the same cost regardless of transaction size. Since the ATV for ecommerce transactions is slightly above $75, most ecommerce merchants will be negatively impacted by these two card types.

Least Cost Routing & Debit Transactions

These changes also have big implications on merchants with strategic partnerships or merchants that are considering least cost routing (LCR).

Partnerships

For merchants with global schemes partnerships and preferential agreements, these deals will diminish, as their strategic interchange fees will now be closer in value to the newly established rates.

Least Cost Routing

For merchants considering least cost routing, LCR can allow them to route transactions to the most cost-effective scheme for their contactless debit transactions.

Since most contactless debit cards are co-badged with either Visa or Mastercard and eftpos, every transaction has an optimal scheme to route through, and merchants need to understand their position for routing across all line item fees in order to properly assess this.

CMSPI estimates that the implementation of debit LCR will create an additional $800 million in annual savings for Australian retailers.⁷

Check out our interview with CMSPI’s Head of Asia Pacific, Robbie MacDiarmid, where we discuss true LCR in Australia.

Will All Retailers Receive These Benefits Automatically?

Quantifying the impact of interchange fee changes for each merchant can become incredibly complicated, especially for merchants with multiple card processing considerations.

With constantly shifting cost of acceptance fees, interchange rates, partnerships considerations, varying optimal routing structures for different rates, and even inconsistent reporting from acquirer-to-acquirer, oftentimes, fee changes do not flow correctly to the merchant.

For every business, it is important to regularly assess your current arrangement and to ensure your payment suppliers are providing card payment solutions that are right for you.

CMSPI completes invoice health checks for hundreds of retailers across the globe to ensure they are not being overcharged. Within those processes, we find that most merchants operate with non-optimal arrangements.

Make the New Interchange Fees Work For You

Conducting an invoice audit is essential to ensure savings are being passed through correctly from your acquirer and that your business is not heavily impacted by mischarges.

CMSPI finds that 1 in every 2 invoices contains a fee error, and often, these appear as new fee regulations are applied.⁸

Especially for large enterprise merchants, the cost of mischarges can add up for a business.

Get in touch with our team to learn more, or check out how we can help you reduce costs and optimize your payment arrangement.

Sources:

+- RBA’s 2021 Amendment to “Standard No.2 of 2016: The Setting of Interchange Fees in the Designated Debit and Prepaid Card Schemes and Net Payments to Issuers” (Nov 18, 2021) https://www.rba.gov.au/payments-and-infrastructure/review-of-card-payments-regulation/pdf/standard-no-2-of-2016-debit-and-prepaid-card-interchange-2021-11-18.pdf

- Refer to footnote 1.

- See Visa Australian Interchange (2022). https://www.visa.com.au/about-visa/interchange.html

- See Mastercard Australian Interchange (2022). https://www.mastercard.com.au/en-au/about-mastercard/what-we-do/interchange.html

- See eftpos Australian Interchange (2022). https://www.eftposaustralia.com.au/interchange-fees-and-principles

- CMSPI Insights

- CMSPI Insights

- CMSPI Insights