Assessing the Proposed Visa and Mastercard Settlement in the Context of Recent Fee Increases

In March, a proposed settlement for U.S. merchants accepting Visa and Mastercard card transactions was released, representing a major milestone in a nearly two-decade class action lawsuit. The proposed settlement would require the networks to introduce 4 and 7 basis point decreases to published and average domestic credit interchange fees, respectively, but how do these decreases compare to recent fee increases for U.S. retailers?

On March 26, the Eastern District of New York released a proposed settlement for U.S. merchants accepting Visa and Mastercard card transactions. Representing a major milestone in a nearly two-decade class action lawsuit, the proposed settlement includes rule and rate changes for U.S. merchants that are reported to generate nearly $30 billion in savings over five years.1 This is separate from previously settled monetary awards in the case, which are currently at the Claims process. But how do the decreases proposed by the settlement compare to the recent fee increases for U.S. merchants?

Settlement by the Numbers

The proposal introduces the following changes to U.S. interchange programs.

1. Published interchange on Visa and Mastercard domestic credit interchange programs to fall by 4 basis points (bps) for three years starting as early as April 2025.

2. System-wide credit interchange fees for Visa and Mastercard to fall by 7bps for five years starting as early as April 2025.

3. A moratorium on applicable credit interchange fee increases, with the baseline set at December 31, 2023, levels. This will last for 5 years, after which prices can increase.

Putting The Proposal in Context

Slowing the rate of increase to payments fees may be welcomed by merchants, but what exactly does 4-7 basis points mean in the context of payments costs over time?

• Average Fees: According to the Nilson Report2, over the period 2017-2023, Visa and Mastercard’s average credit card fees rose by 9 basis points, with a 4 basis point increase from just 2021 – 2023.

• Fees for Certain Merchant Types: Recent rounds of interchange increases have disproportionately affected merchants in certain verticals or channels. For example, based on published interchange rates, certain card types for common interchange categories have increased by over 40bps since 2020.3,4

• Fees for Different Card Types: Some high-rewards cards attract published interchange rates significantly that are higher than other card types. For example, published rates for a Visa signature preferred card for an in-store retail transaction sit at 2.10% + $0.10.5 A 4bps reduction represents less than a 2% reduction in the published rate for this common transaction type.

• Fees Outside of Interchange: Lastly, there has been a steady stream of network fee increases since 2011, when the first of many material network fees were introduced. In fact, over 40 global network fees have been introduced or increased since 2011.6 Just this April, Mastercard and Visa have announced a variety of new network fees, with one reportedly expected to cost merchants over $250mn annually.7

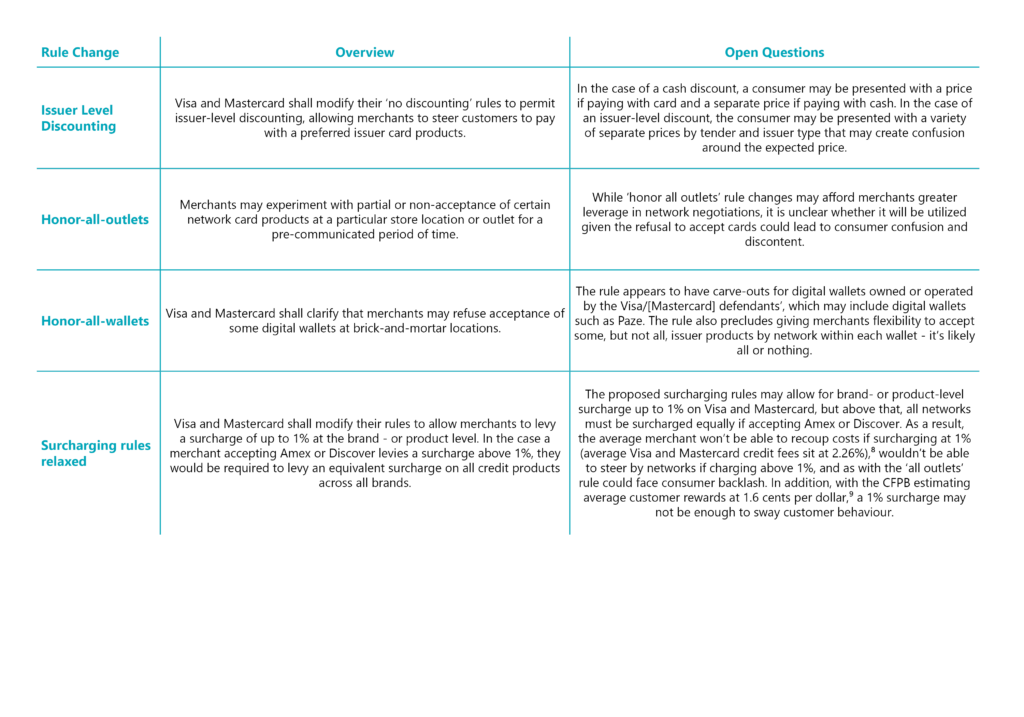

Proposed Settlement Rule Changes and Open Questions

The proposal would also introduce changes to network rules 90 days after the settlement approval date. One could argue that these rule changes may put additional downward pressure on fees or potentially help merchants with cost recoupment; however, the ease and impact of implementation are somewhat unpredictable. Here’s an overview of the rule changes and potential open questions associated with each:

What other solutions could make a difference for merchants?

If debit reform learnings have taught us anything, it’s that competition has led to lasting reductions in cost of acceptance. For example, while credit rates have climbed steadily from 2010-2023, PIN debit rates, which are typically routable and exhibit high levels of competition compared to credit, have actually fallen in that period.10

As of 2023, Visa and Mastercard reported combined annual U.S. credit volumes of $4.5 trillion. Based on this, a 7bp reduction in interchange would result in $3.1 billion in annual savings or $15.5 billion over 5 years. CMSPI estimates that the Credit Card Competition Act could save merchants over $15 billion annually ($75bn over five years) and would introduce to the credit market the similar competitive pressures that have led to decreasing PIN debit rates since 2010.

While the settlement is not yet finalized, merchants should be vigilantly monitoring their invoices for errors and mischarges, as network strategies today will depend on setting data-driven baselines and comparing those to market-leading performance in the future.

CMSPI is not a legal firm and does not engage in the provision of legal services or legal advice. Nothing within this (blog, document, etc.) should be interpreted as legal advice or guidance. For any legal services, please contact a qualified legal expert.

Sources

+1 https://www.reuters.com/business/finance/mastercard-visa-reach-30-bln-settlement-over-credit-card-fees-2024-03-26/

2 Nilson Report issuers 1131, 1216, 1259

3 Visa USA Interchange Reimbursement Fees

4 U.S. Region Interchange Bulletin (mastercard.us)

5 Visa USA Interchange Reimbursement Fees

7 Ibid

8 Nilson Report

9 2023 Consumer Credit Card Market Report (consumerfinance.gov)

10 Ibid