Cutting Costs, Not Corners: The 2024 Guide to Least Cost Routing for Aussies

In today’s economy, Australian businesses are keenly aware that every dollar counts, and efficiency is king. In payments, the spotlight is shining bright on least cost routing (LCR) as a mechanism for businesses to lower payments costs without compromising on customer experience. With LCR expanding to both online and mobile wallet transactions this year, what should be top of merchants’ minds?

“I’m New, Catch Me Up… What is Least Cost Routing?”

At its core, Least Cost Routing (LCR) – more specifically Merchant Choice Routing – is a process that enables merchants to send a card transaction via the network of their choice. It can only be exercised on dual-network debit cards (DNDCs): cards that are badged with at least two networks. As of 2021, DNDCs represented over 90% of Australia’s debit cards.1 Given the cost differentials between card networks for certain transactions, CMSPI estimates that full availability of LCR for debit cards in Australia could place $800 million in annual savings on the table for businesses.

“What’s Happened So Far?”

The Reserve Bank of Australia (RBA), which is responsible for the competition and efficiency of the Australian payments system, has supported the development of LCR as early as 2016. There are two major steps they’ve taken to protect merchants’ choice over routing.

1. RBA Directive and Penalty on Single-Badged Cards: The RBA has set an expectation that all large debit card issuers will only issue dual-network debit cards. To discourage the issuance of single-network cards, it also introduced a second weighted-average interchange cap for SNDCs at 8 cents – equivalent to that of DNDCs – to minimize the differential in fees between the two.

2. Direct Oversight by RBA: The RBA has mandated all acquirers and payment facilitators to offer and promote LCR to merchants for in-person and online transactions, expecting reports every six months on LCR offerings and merchant uptake. This oversight aims to increase the adoption and benefits of LCR for merchants.

LCR in 2024: a Year of Milestones and Challenges

2024 is shaping up to be a watershed year for merchants, marking the first significant leap towards bolstered LCR adoption since 2022. For the first time, the industry will be expected to develop LCR functionality for mobile wallet transactions, expanding routing availability by 12% and making the full $800 million in estimated savings for merchants with a robust LCR strategy.2

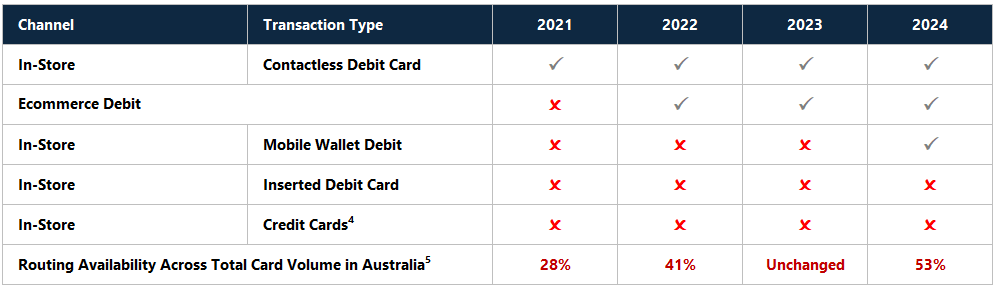

Table 1 Merchant Choice Least Cost Routing Rollout from 2021 to 2024

However, while the RBA has set ‘expectations’ that acquirers and payment facilitators offer and promote LCR across these different payment channels, these expectations are not explicit legal requirements. The actual availability of LCR, as experienced by merchants, can still lag behind the RBA’s expected rollout schedule.3,4

Bridging the Gap in LCR Availability

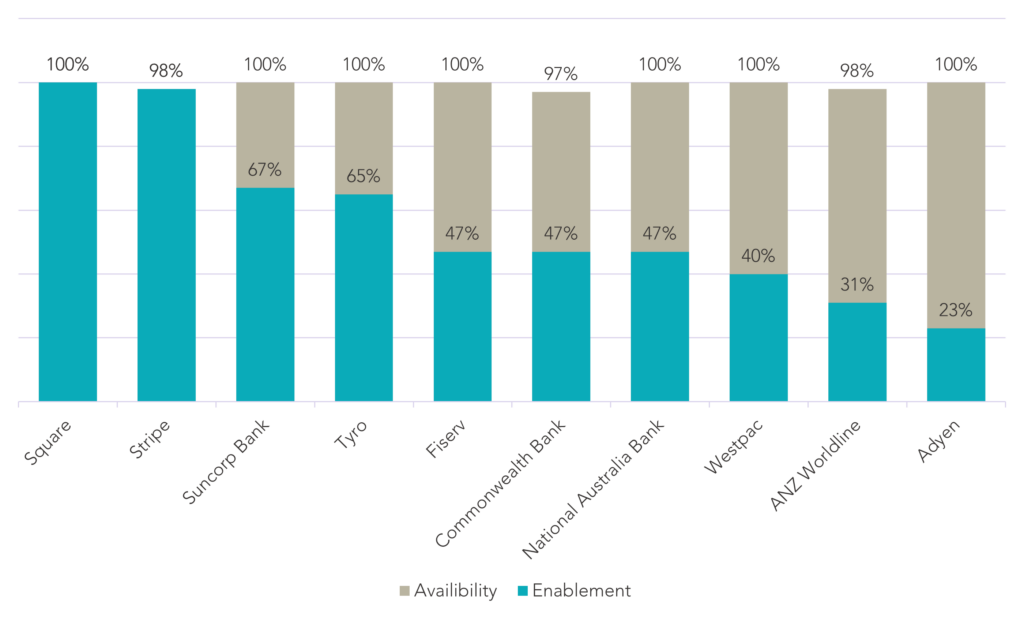

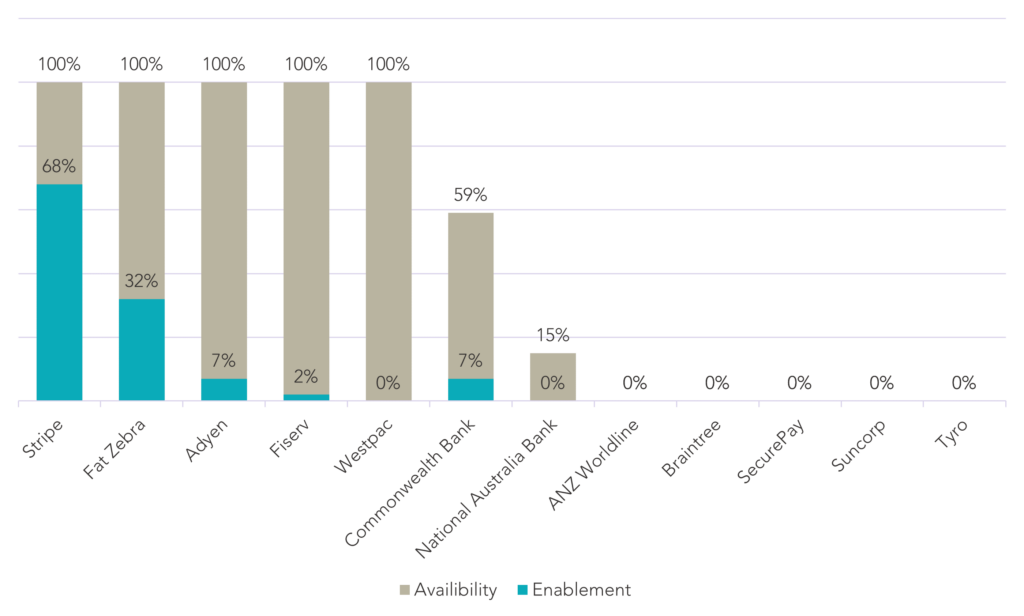

According to the RBA’s latest statistics, 99% of all merchants are now able to practice LCR on card present transactions (Table 1).5 This success in availability has not been the same for card-not-present transactions. Even though online routing was expected of providers by the end of 2022, the RBA reported that availability rates still lagged behind card-present levels for most providers in 2023 (Figure 2).

Figure 1 Card-Present LCR Stats in December 20236

Figure 2 Card-Not-Present LCR Stats in December 20237

Despite anticipated improvements in 2024, the rollout of LCR continues to delay beyond set expectations, underscoring the need for continued efforts from merchants, payment providers, and regulators to push for progress.

“Why is a Routing Strategy So Important?”

Public statistics suggest that the average cost of eftpos, the local debit network in Australia, is around 0.34% of the transaction value, compared to the global debit networks at 0.51%.8 These significant cost differentials present a compelling case for merchants to turn on LCR. By generating competition between networks, businesses can realise cost savings, improve control over their fees, and potentially even gain a competitive advantage on underlying processing costs compared to other merchants in market.9

Yet these public stats only tell half of the story.

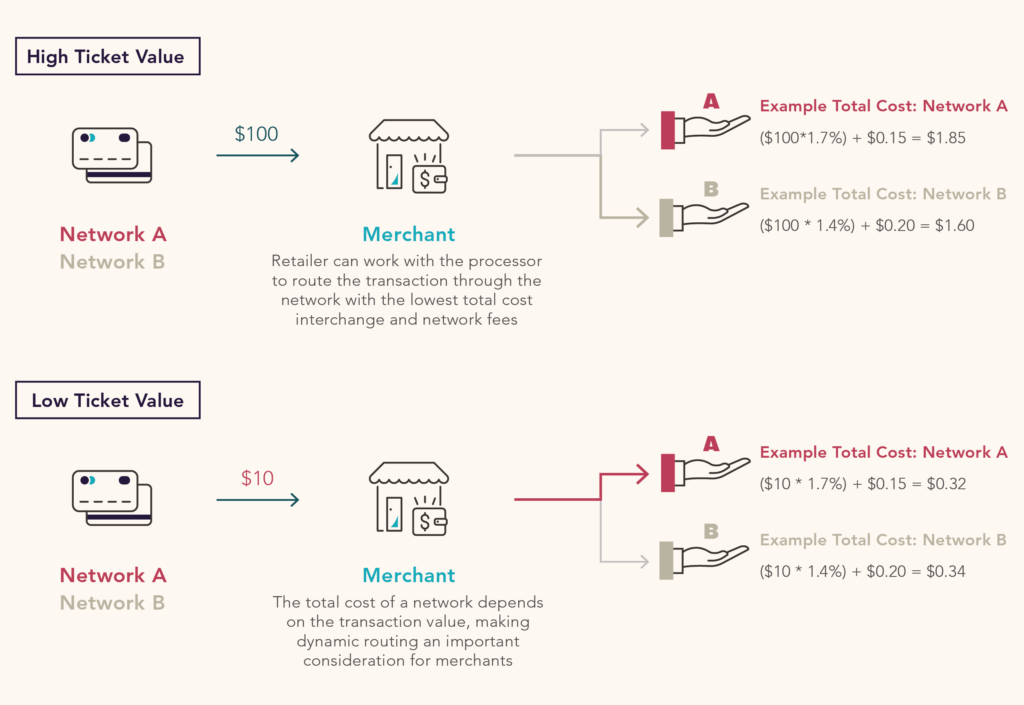

Routing choice is based on the interplay of various transaction attributes – value, card type, channel, POS interaction, and merchant-specific strategic rates. As an example, lower-value items may be more expensive to process via networks that charge more fixed fees.

Figure 3 Transaction Flow with Routing – High vs Low

The opposite can be true for high-value items where fixed fees will be less expensive to process than percentage. It’s the deeper, more micro-analysis of these figures, shaped to each business’s profile, that can be the key to truly maximizing value for each transaction. As the RBA continues to push for LCR advancements, merchants with the data to take advantage of new routing volumes are expected to lead the pack.

2024 also brings the topic of network tokenisation into focus for merchants keen to enhance their routing capabilities online. By March 2024, eftpos is expected to enable network tokenisation for merchants, aligning its offerings more closely with those of global networks, which already provide network tokenisation.10 Simultaneously, all card networks are expected to develop standardised token migration services between gateways or payment service providers. While network tokens are not required on all transactions, you may inadvertently be accepting them through your mobile wallet transactions, since pass-through wallets automatically tokenise the transactions. With these new directives, merchants routing transactions will be able to switch network tokens between providers seamlessly even on their mobile wallet transactions.11

“So, Tell Me This… Am I Prepared to Route Optimally?”

Understanding the payments landscape and providers’ different offerings for dynamic routing, tokenisation, and availability is key to effectively implementing a forward-looking, routing strategy. Whether you’re new to LCR or seeking to refine your existing approach, starting with a thorough analysis of your current acceptance costs and unique business profile is essential to ensure that your strategy is aligned to your specific needs.

As progress continues with policy intervention and broadening support from providers, merchants should actively explore and understand their providers’ capability to support LCR technology in all card environments. This exploration is not just about turning on LCR; potential savings for a merchant be further extended with detailed data analysis and skilled negotiation with the networks to improve strategic rates. In one case, CMSPI enabled a merchant to gain over $1 million in annual savings through providing data-driven insights to support least cost routing strategies and negotiations.12

This year presents an exciting and unprecedented opportunity for merchants, especially those looking to improve the budget books, but the true value of Least Cost Routing inevitably lies in your strategy.

Sources

+2 https://www.rba.gov.au/payments-and-infrastructure/debit-cards/least-cost-routing.html

6 Ibid.

7 Ibid.

8 https://www.rba.gov.au/payments-and-infrastructure/resources/payments-data.html

9 RBA Sept 2023 Average Merchant Fees for Debit, Credit, and Charge Cards.

12 RBA Sept 2023 Average Merchant Fees for Debit, Credit, and Charge Cards. RBA Sept 2023 Average Merchant Fees for Debit, Credit, and Charge Cards.