Ecommerce Battlegrounds: Fortifying Your Online Revenue Against Fraudulent Refunds and Chargebacks

In an era where digital transactions form the backbone of global commerce, protecting online revenues against online fraud is more important than ever. The latest data from the Nilson report reveals a concerning trend: the U.S., despite making up only a quarter of global card volume, accounted for nearly half of the world’s total card fraud losses in 2022, amounting to a staggering $13.61 billion in lost revenue. 1

This alarming statistic speaks to two of the most important KPIs for payment managers globally: the number and value of refunds and chargebacks. But what happens when these customer protections are exploited by fraudsters?

Understanding Refunds and Chargebacks

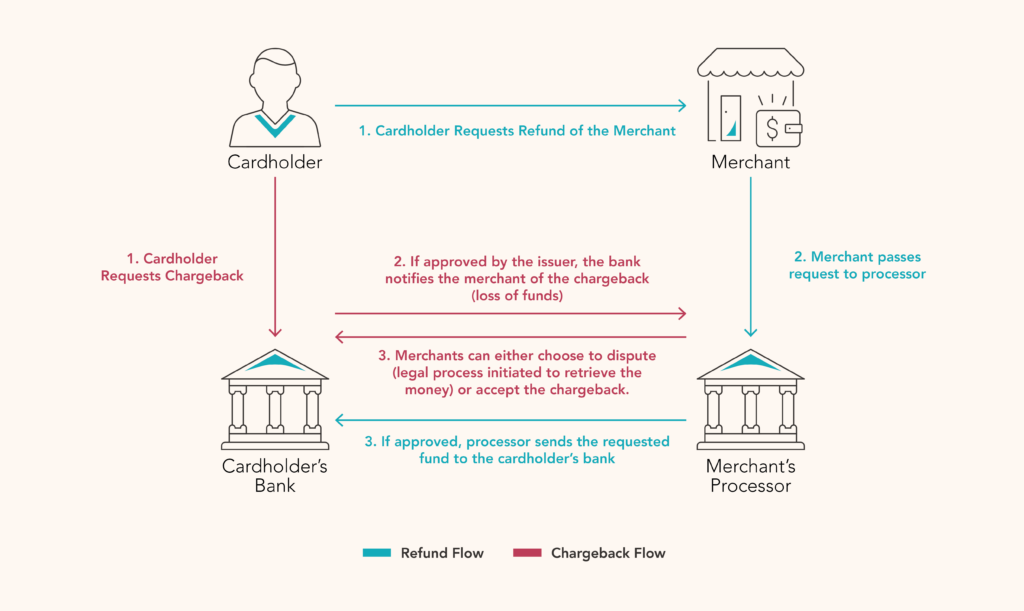

Refunds are financial mechanisms for returning funds from a merchant to a customer. If, for example, a customer is unhappy with an item or never receives it, they first request the return of funds from the merchant. If approved, the merchant initiates the return of funds to the customer.

The same customer entering a chargeback process would usually start by requesting the return of their funds directly through their issuing bank. They may take the chargeback route if they believe their account has been used for a fraudulent purpose, or perhaps if they have not received an item they have been charged for.

How Does the Chargeback Representment Process Work?

When a chargeback is filed, the issuing bank first investigates the customer’s claim and, if upheld, funds are returned to the customer’s account. Upon receiving a chargeback notification, the merchant can choose to either accept or dispute the chargeback through a process called representment. If the issuer sides with the cardholder at this stage, the merchant may choose to escalate the dispute to ‘pre-arbitration’ and ultimately ‘arbitration’, where the card network is responsible for evaluating evidence from both sides. In many cases, the merchant has up to 30 days to respond before a chargeback is automatically approved.2

Why don’t merchants always fight chargebacks?

Aside from the costs associated with the representment process, one of the most difficult balancing acts in payments is between fighting fraud and protecting the customer experience. If Jenna claims she did not receive her item, she could be acting fraudulently. But maybe her claim is true. Perhaps there was a shipping issue, or Jenna is one of the 14% of Americans who experienced package theft in 2022.3 If the merchant chooses to dispute her chargeback and the issuing bank finds in their favor, then Jenna has had to pay for an item she never received and waste her time disputing a payment. That is a terrible customer experience, and could lead to the business losing the lifetime value of Jenna as a customer over a single item.

However, it is important to recognize that offering refunds or not disputing chargebacks indiscriminately – while it may be a customer-centric approach to doing business – could leave merchants exposed to exploitation by those looking to abuse the system.

Fraudulent Refunds and Chargebacks – What’s the Risk?

Not all misuse of refund and chargeback processes is intentional. For instance, if a customer makes a purchase on a joint account and their spouse doesn’t recognize it, they could dispute the transaction. But within both mechanisms lies the potential for deliberate abuse. According to the Merchant Risk Council’s 2023 Ecommerce Payments and Fraud report, first-party misuse (which includes chargeback fraud) was the second-most experienced form of fraud in 2023 – up from fourth place in 2022. In fact, a shocking 62% of survey respondents reported an increase in these ‘friendly fraud’ disputes since 2021.4

Technically speaking, refund abuse occurs when a customer repeatedly requests refunds under false pretenses. It may be a particular issue for businesses that do not track refund requests by frequency or identifier. Chargeback abuse is similar, but involves a customer opening fraudulent chargeback disputes via their issuing bank.

There are lots of ways in which both cost merchants and issuers dearly. Taking a chargeback as an example, the merchant is exposed to losing:

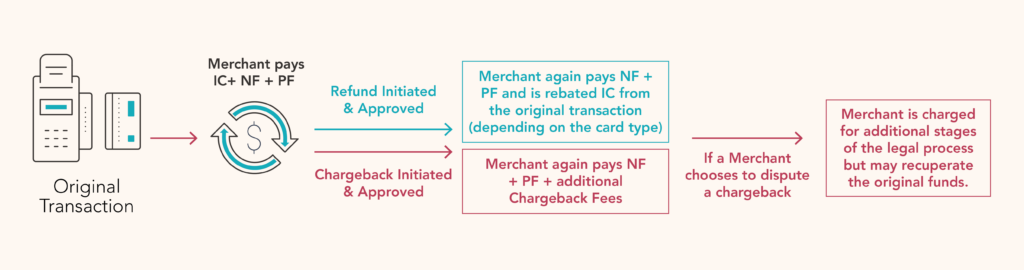

- The value of the item – In the case of physical goods, the merchant loses the amount refunded or charged back as well as the re-sale value of the item, doubling the amount lost

- Fees – Merchants may experience processor chargeback fees, as well as multiple network fees related to refunds and disputes, such as fees for providing dispute resolution image documentation. There is also a risk that interchange fees are not returned on a refunded item – not to mention the extensive costs associated with chargeback arbitration for both merchants and issuers.

- Disciplinary costs – Merchants whose chargebacks exceed acceptable levels – as determined by the card networks – may be placed on monitoring programs that attract significant fees. They may also be deemed ‘high-risk’ by their processing partners, affecting their standing in the industry.

- Other costs – These include things like the time spent for an employee to put together a case for representment, arbitration costs, or the possibility that a customer initiates a chargeback before they receive a refund and the amount is deducted from the merchant’s account twice. Refund processes can also result in multiple contacts to a merchant’s customer service center, which may be exacerbated by the lengthy settlement times in which stakeholders process the refund to the customer’s account.

Building a Resilient Payment Ecosystem: What Are the Experts Saying?

Unlike banks, which have a broader perspective on a customer’s transaction history, merchants often operate in silos, unaware of the refund activities associated with a customer across different businesses. This makes it extremely challenging for merchants seeking to validate the legitimacy of a refund or chargeback request – especially when fraudsters use multiple cards, emails, and phone numbers to obscure their activities.

In CMSPI’s January 2024 Townhall, Justin Staskiewicz brought together industry leaders to discuss the latest trends in fraud. The team noted a rise in card-testing and policy abuse, as well as a tendency for fraudsters to blend into busy environments, especially during peak seasons.

With that in mind, one of the panel’s biggest takeaways was that merchants can’t rely on their fraud detection tools alone. Instead, the key to navigating the complexities of digital commerce lies in adopting a multifaceted approach to fraud prevention. That includes tightening return policies, employing advanced fraud detection technologies, keeping abreast of market-wide trends, and maintaining a dynamic strategy that adapts to emerging threats. As with most complex payment acceptance challenges, it will be the merchants with accurate, actionable data to make informed decisions and build fraud-fighting strategies that will lead the pack.

Sources

+