Fighting the Fees: Time for Merchants to Step in the Ring and Fight Scheme Fees

Rising scheme fees are nothing new. European merchants have been plagued by these continually increasing costs for years – and, for many, they have become a frustrating yet inevitable part of processing payments in the 21st century. But does it really have to be that way?

Concerns with rising scheme fees are serious. Not only do they directly undermine and dampen the benefits of regulation for merchants but, ultimately, they will have a knock-on effect on the price of goods for consumers. We’re increasingly seeing new charges introduced and existing fees increased with little or no tangible justification – and the payments community is left wondering where these rising costs will end.

In this article, we take a close look at the impacts of the increases we’ve seen so far; the upcoming changes in 2020; and the options available to both merchants and regulators to end excessive card fees once and for all.

The Cost to Merchants

Since the 2015 introduction of Interchange Fee Regulation (IFR) and the 2016 purchase of member-owned Visa Europe by profit-driven Visa Inc., merchants have faced significant increases in scheme fees for both Visa and Mastercard transactions. As a result, CMSPI estimates that the merchant community has paid an additional €1.44 billion to the global schemes since 2016.

A new round of Visa fee increases, scheduled for January 2020, is estimated to cost European merchants almost €134 million in additional fees per year – one of the biggest increases we’ve seen so far. Beyond its associated costs, the Acquirer Association Fee is also becoming significantly more complex: rates will vary from country to country and certain Merchant Category Codes will be exempt from the increases until 2021. For those retail sectors operating on particularly fine margins, the impacts of these fees can be substantial – but merchants’ pain doesn’t end there.

Scheme fees are passed on to merchants via their acquirer. As a result, we’ve seen numerous examples of these fees further increasing throughout the payments supply chain. So not only are your Visa and Mastercard fees soaring but, if you don’t have full visibility of your transaction fees, you could be pinched for extra fees elsewhere too.

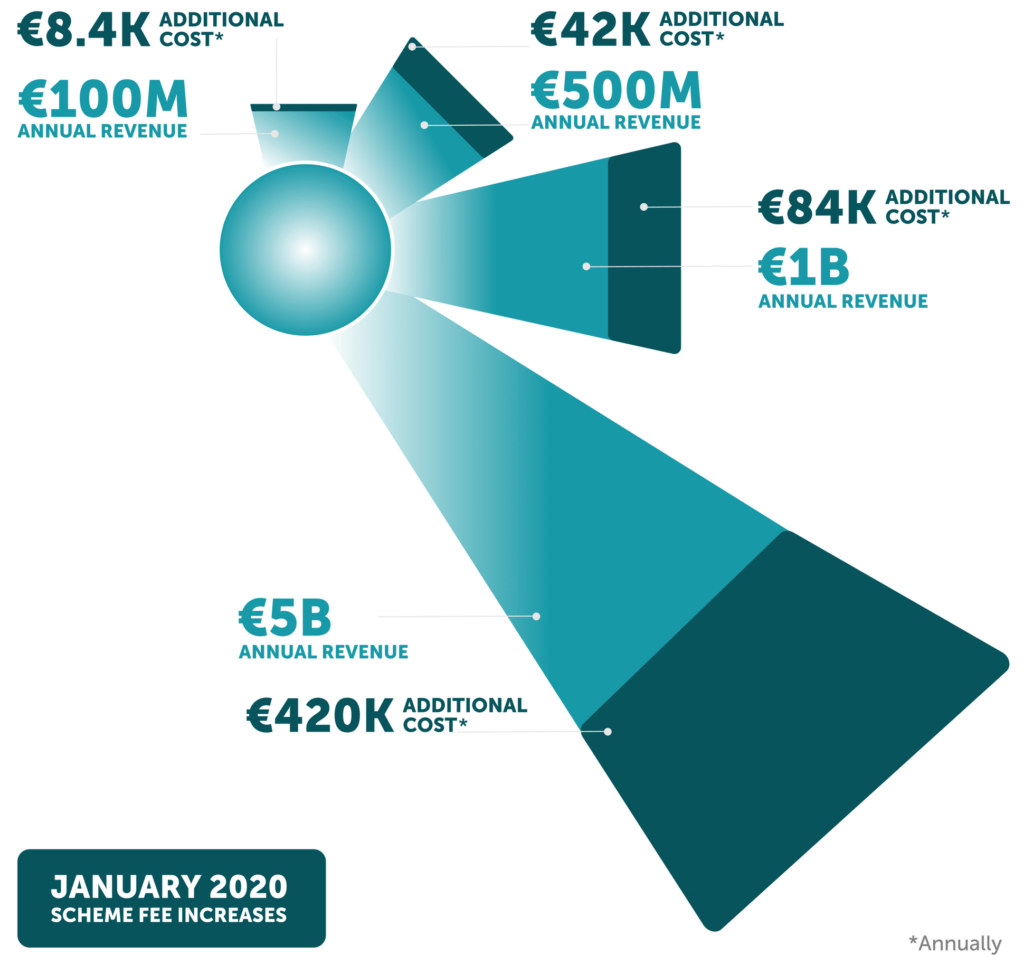

Although some sectors will be exempt for the first year, in the long-term these scheme fee increases will impact each and every merchant. See the infographic below to find out how your business will be affected.

Scheme Fee Increases By Merchant Revenue

“As recently as April 2019, the CEO of Visa Inc., Alfred Kelly, stated: “Pricing is something we look at in the business on a continual basis. And we will continue to do that around the globe and in Europe. And it’s a lever that we’re well aware of and will continue to pull as we think the value that we deliver is commensurate with that.”

Jennifer O’Neill – Senior Payments Consultant