Putting Profitability First: Is PINless the Answer Tech Companies Have Been Looking For?

Since the 2011 Durbin Amendment, the biggest lever U.S. merchants have had in controlling their payments costs came in the form of PIN debit optimization.

Since the 2011 Durbin Amendment, the biggest lever U.S. merchants have had in controlling their payments costs came in the form of PIN debit optimization, which saw merchants secure strategic rates for routing their transactions via one of the multiple available networks on each card.

The problem? PIN debit rarely left the store. With the Fed’s most recent announcement, billions are now being put on the table in the online environment too – right as the economic climate shifts tech businesses’ focus towards their bottom lines.1 But where does online debit routing fit into a sustainable growth path, and how can it help put profitability first?

It’s Time to Talk Costs

In 2020, customer acquisition was the name of the game. And as economic stimulus packages, low interest rates, and reduced overheads abounded, tech businesses with strong customer base growth unlocked billions.² But today, many are heeding the writing on the wall. As purse strings tighten with climbing inflation3, reports predict that 150 million people will cancel a paid streaming subscription in 20224, shifting the tech CFO’s focus to customer retention and protecting EBITDA during a potential downturn.

Nowhere has the acquisition-to-optimization transition been clearer than in payments. With the boom in online volumes and the digitization of commerce over the past few years, payments has become a strategic enabler for growth. Tech-focused merchants were often the first to wake up to this reality, and set their sights firmly on sales growth; terms like frictionless, incremental and one-click became core to optimizing the checkout and getting customers signed up as seamlessly as possible. Then, scaling meant tolerating inefficiencies in new markets in exchange for maximizing subscribers or repeat orders. But between rising interest rates, a squeeze on supply chain costs, and increasingly-expensive debt, profitability is front of mind – and that’s where PINless comes in.

The PINless Breakthrough

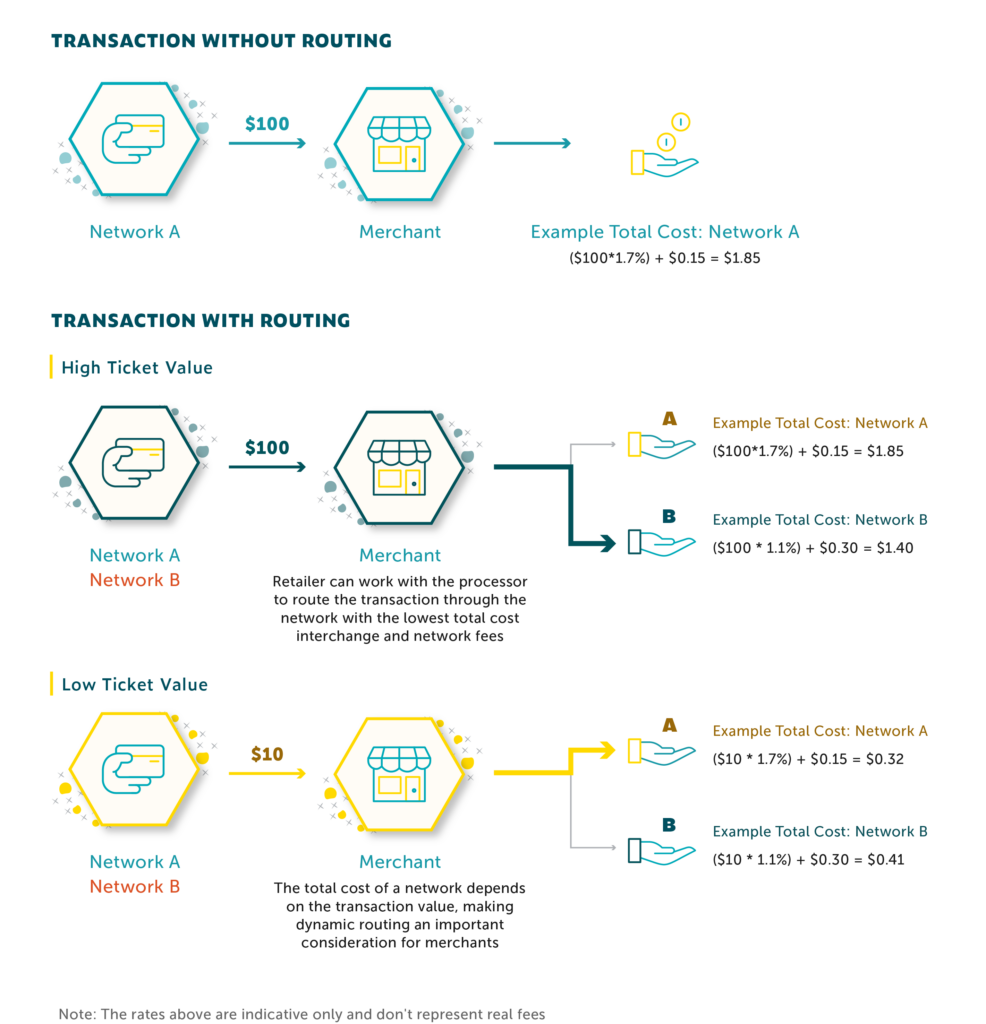

Since 2011, the strongest tool to address payments costs under merchants’ belts has been debit routing (Figure 1). With the Durbin Amendment, all U.S. debit cards were required to be badged with at least two unaffiliated networks, allowing merchants the opportunity to negotiate directly with the available networks to secure strategic rates for the processing of their transactions. With the right strategy, data, and network leverage, merchants have been able to secure significant savings to be reinvested in their own growth strategies.

But until now, that opportunity was centered around in-store spending. The ‘PINless’ technology needed to allow routing choice for Card Not Present transactions saw limited enablement, leaving online retailers out of the loop. That all changed in October, when the Federal Reserve announced a clarification that guarantees merchant choice over Card Not Present transactions5 – opening the doors to an estimated $3bn in additional annual savings for those with the expertise to claim it.6 With this move, tech companies are seeing a core asset for revenue generation turn into one of their most precious cost levers at a time when every penny counts.

Figure 1: What is Debit Routing?

Payments: From Growth Lever to Profit Driver

As the focus turns to business’ books amidst reports of potential recession,7 it’s more important than ever that companies get their houses in order. For many, debit has been a huge resource so far – one that in-store merchants have had down for years. Those merchants have long been navigating the complex terrain of sub-optimal routing tools, volume commitments, and network issuance shifts, and are now readying themselves for renewed negotiations with their network and processing partners as a result of the clarification. But PINless will be a new frontier for everyone, as all parties – from issuing banks, to merchants’ in-house tech teams – prepare for the requirements by July 2023.

So, what are CMSPI’s top tips to ensure merchants act in time?

Evaluate the barriers

+Know the capabilities of each of your payments partners, from BIN enablement rates, to network tokenization, to gateway and processor routing tools.

Put customers first

+Understand how PINless can enhance the customer experience, and what that means for your checkout flow.

Act now

+Getting it right takes time; the payments-savvy are already harnessing their transaction data, understanding their network mixes, and building custom roadmaps in preparation for the shift.

With billions on the table, the key for tech merchants – traditionally first-movers in the latest that ecommerce has to offer – will be ensuring that their payments aren’t late to the game.

Sources:

+- https://medium.datadriveninvestor.com/startup-founders-beware-growth-at-all-costs-is-no-longer-in-vogue-b2d5e9ac3619

- https://www.solving-finance.com/post/the-transition-from-growth-at-any-cost-to-sustainable-growth

- https://www.bloomberg.com/news/articles/2022-10-18/even-as-us-inflation-climbs-wall-street-sees-steep-fall-coming?leadSource=uverify%20wall

- https://www.thestreet.com/lifestyle/-streaming-cancellations-are-coming-will-they-impact-disney-and-netflix

- https://cmspi.com/nam/en/resources/content/card-not-present-routing-the-3-billion-opportunity-for-merchants/

- CMSPI estimates and analysis

- https://www.reuters.com/world/us/ex-treasury-secretary-mnuchin-says-us-recession-will-continue-2022-10-26/

Infographic: The $3 Billion PINless Routing Opportunity

Get to grips with the PINless opportunity in our latest infographic.

View now