Why Payments and Loyalty are Now Intertwined for Gas Merchants

It never used to be this complicated. Consumers would typically use the first gas station they found. If they found more than one, they’d go for the cheapest option.

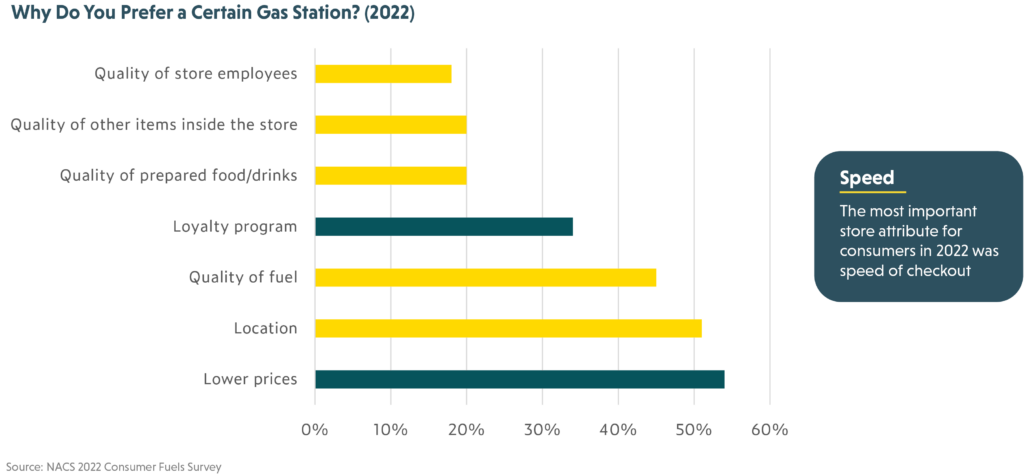

Lower prices and location are still vitally important for gas stations of course, as they rank numbers one and two on the list of “why do you prefer a certain gas station” in NACS’ 2022 Consumer Fuel Survey.

However, they no longer have full jurisdiction over consumer decision making, because one other key factor is quickly rising up the charts: loyalty.

The concept of loyalty may not be new for gas stations, but it has evolved in both its scope and its importance. Loyalty now encompasses three main areas for gas stations:

1. Loyalty by improved customer experience

Getting loyalty right isn’t just about app-based rewards programs, it’s about optimizing the wider customer experience.

In NACS’ 2020 Consumer Fuels Survey, more than half of respondents (52%) said “store gets me in and out the fastest” was their most important factor when selecting a store. There are several ways that gas stations can optimize the speed of checkout in their stores, including automated checkout technologies and delivery services for store products and fuel.

In addition, leading gas stations are also looking to boost the customer experience by looking into several newer areas such as license plate scanning, EV charging, biometric payments and even Bitcoin acceptance. New checkouts and new payment methods are making cars ‘wallets on four wheels.’

Change has been driven by technological innovation, but also factors such as the pandemic, increased supply chain costs, and increased digital usage by consumers. This has opened the door for new ways for merchants to engage with consumers and market leading gas merchants are investing in the consumer experience more than ever. With the digitalization of payments, merchants are now (with their approval) collecting more information from consumers and using that information to tailor customer experiences.

2. Loyalty through rewards

Gas station customers are becoming increasingly loyal: 62% of respondents to NACS Consumer Fuels Survey said “yes” when asked if they prefer a certain chain or store, compared to just 31% in 20121. One of the key vehicles market-leading gas stations are using to drive loyalty is through app-based rewards programs, which often offer a discount per gallon of gas or store rewards. This is now a high stakes game: 64% of consumers responding to NACS’ survey said they would drive 5 minutes out of their way and 60% said they would take a left-hand turn across a busy street to save five cents a gallon on gas.

However, despite the clear attractiveness of such savings to price sensitive consumers, gas stations must make sure there is an ROI for price discounts, which can be challenging in a low margin business. In this regard, they can be helped by their payments teams…

3. Loyalty to reduce the cost of payments

It is clear that in order to drive the kind of loyalty programs, customer experiences and lower prices that consumers increasingly crave, gas merchants need to ensure their payments and loyalty teams work in tandem.

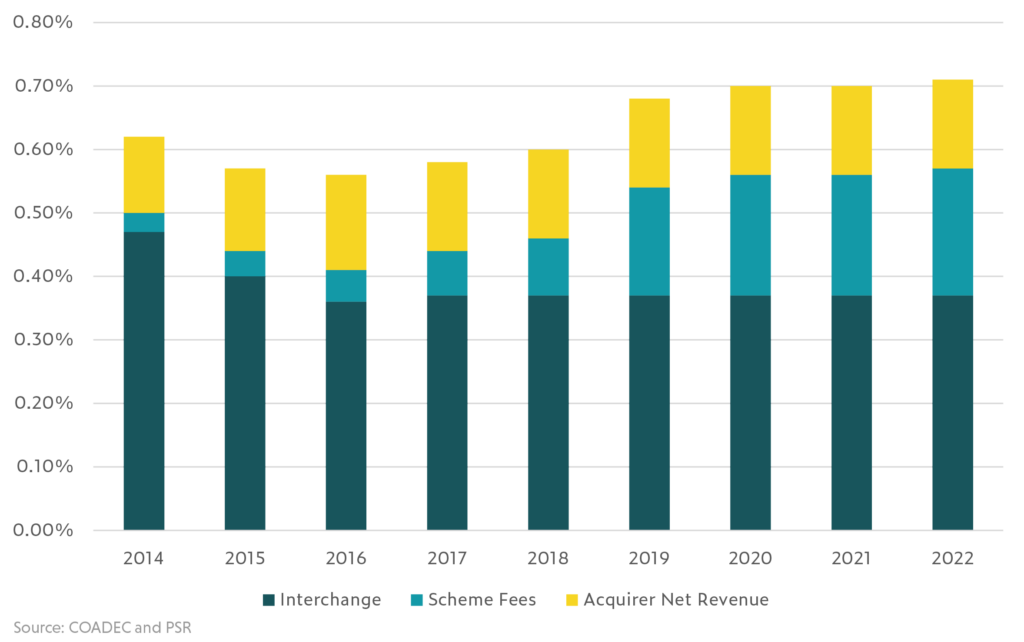

In setting up a loyalty program, gas merchants have the ability to encourage customers to use optimal payment methods that balance customer demands for convenience, speed, and security along with merchant priorities for low costs and high authorization rate performance, among other considerations. The cost of card acceptance has been rapidly rising for gas merchants in recent years, with the average card merchant service fee Europe now higher than it was pre-interchange fee regulation in 2015 due to rising unregulated network fees now in excess of 70 basis points (see Fig 1). For many gas stations, card costs are now their second highest cost item behind labor (or sometimes third behind premises).

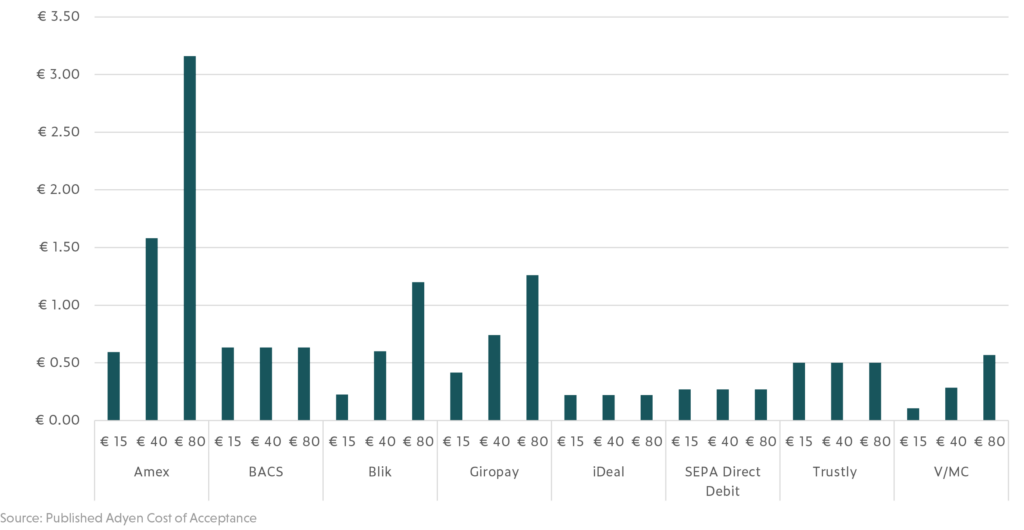

Alternative payment methods (APMs) are growing, and crucially can be much cheaper for merchants to accept. For example, direct debit schemes can be much cheaper than cards due to underlying costs that are close to zero. There’s also open banking and instant payment rails to consider. There are huge variations in costs between payment methods, and costs can vary significantly depending on transaction values too (Fig 2):

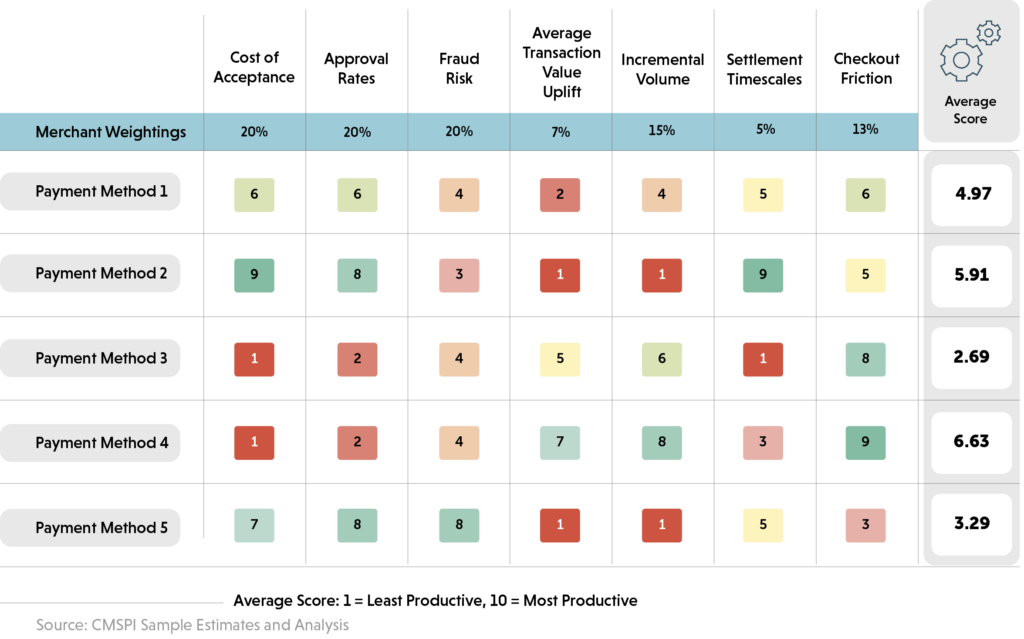

Payment teams need to consider which APMs to accept but perhaps more crucially, which ones to steer customers to use – ones that aligs with customer and merchant priorities. A good way to do this is to develop a scoring matrix of payment methods (see Fig 3):

The key issue that payments teams face is that customers need a good reason to part with their habit of whipping out their plastic card for every transaction. The solution here lies in loyalty, and rewards programs, which typically sit with marketing teams. If these two teams are aligned then loyalty apps can guide customers to a preferred top-of-wallet payment method that enables a seamless customer experience and tangible price savings; whereby, subsequent card cost savings can be used to further enhance merchant-driven customer rewards in a virtuous circle.

Conclusion

In a changing world, selling gas is more complicated than ever, but this provides many exciting opportunities. With new technologies and evolving customer habits, there are distinct opportunities for market-leading gas stations to increase sales and reduce costs, but it requires teams to work together.

The connection between payments and loyalty teams can potentially deliver tangible card cost savings and direct monetary rewards for customers, but if the customer experience isn’t optimal then apps and APMs won’t be used. Gas merchants need to think about authentication technology, and how they can use innovations such as biometrics and license plate scanning to increase speed at checkout – both in store and at the pump. This requires coherent interaction between your app and existing POS payments infrastructure, which requires coordination between payments and loyalty teams.

Gas merchants need to use data and strategic insights to develop a robust enterprise-wide strategy for interacting with customers. This involves pricing, which now involves loyalty, which in turn involves payments. The customer experience involves both payments and loyalty too. Loyalty is no longer a “nice to have” and your payments team are now integral to optimizing costs while maximizing the customer experience. Loyalty is now a high stakes game, and can be the difference between the next customer turning left into your gas station or turning right into your competitor’s.