Payments in 2024: The Outlook from Industry Experts

In its December 2023 Townhall,1 CMSPI asked industry experts Holly Tjaden, U.S. Payments Manager for McDonald’s, and Lorin Young, Global Payments Manager at Columbia Sportswear, to unpack the challenges and triumphs of the last year in payments. But what’s next? From Artificial Intelligence to the familiar ‘soft landing’, here’s what payments managers are looking out for in 2024.

A Soft Landing After All?

In early 2023, high inflation, an inverted yield curve and global conflict all seemed to point in the same direction, and commentators began predicting a recession with up to 100% certainty.2,3 All eyes were on the Federal Reserve’s ability to manage a ‘soft landing’ – an outcome which would slow inflation and avoid recession in tandem.4,5

Today, that hope seems much closer to reality. Falling inflation and an improved job market6 have left many confident that the Federal Funds Rate has peaked7 and that an official slump could be off the cards.8

But in the case of Business-to-Consumer payments, what really matters is consumption: what’s in your customer’s wallet, and how willing are they to spend it?

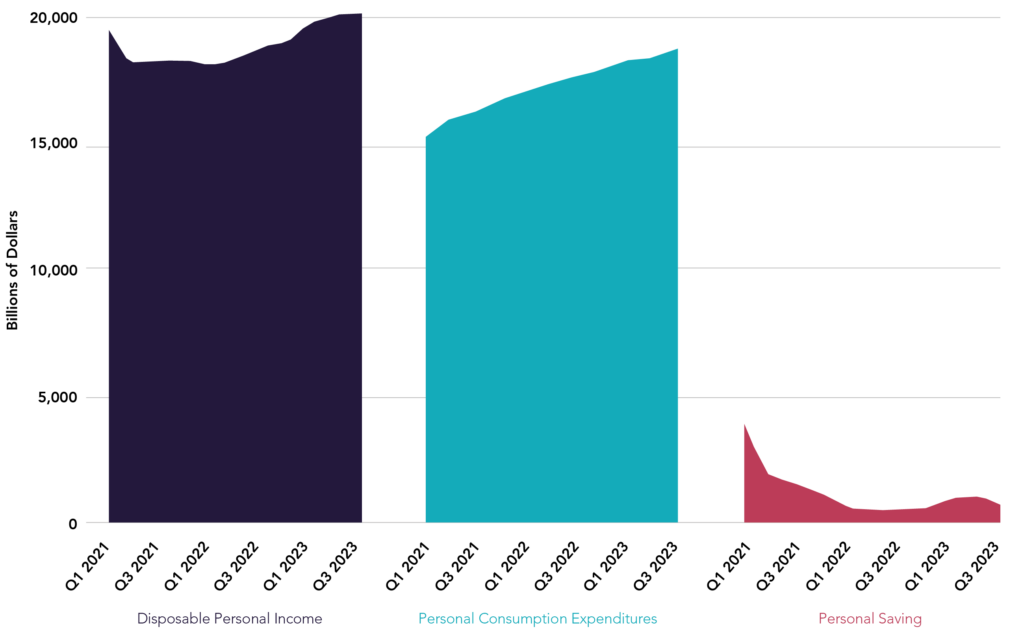

Last year, U.S. consumers defied expectations and ramped up their spending.9 However, this came in part at the expense of personal savings (Figure 1), and with preferences for alternative payment methods such as Buy Now Pay Later which saw its usage hit all-time-high on Black Friday.10 Observers like JP Morgan’s Ginger Chambless now point to low saving rates – as well as factors like rising millennial credit card delinquencies and the restart of student loan payments – as indicators that consumer spending could be set to slow in 2024.11

Predicting these trends can be crucial for payments managers when forecasting Average Transaction Values and payments volumes for the year ahead. But they need to remain ready for surprises; for example, the end of 2023 brought increasing evidence of a Lipstick Effect12 – the idea that times of economic stress can lead people to indulge in small, discretionary purchases that provide emotional uplift13 – spelling potential success for some merchants despite headwinds.

Figure 1. Personal Income and Its Disposition.

Source: Bureau of Economic Analysis.

Policymakers Stay in the Game

One of the key takeaways from CMSPI’s 2023 wrap-up was the undeniable increase in regulatory scrutiny that payments has seen in recent years.

2024 looks set to be no different, with key milestones including the anticipated official release of the revised cap on debit interchange fees from the Fed,14 potential regulation of Buy Now Pay Later,15 and the CFPB’s final rulemaking on personal financial data rights which could further set the stage for Open Banking in the U.S.16

Merchants will also be studying their data closely to ensure that 2023’s requirements are implemented properly, including issuer enablement of the ‘PINless’ technology needed to access debit network competition in environments where customers don’t enter a PIN, such as online.17

Perhaps the most eagerly anticipated news of all, though, is a potential vote on the hotly debated Credit Card Competition Act,18,19 which could open up credit cards to network competition and save merchants an estimated $15 billion in annual card costs.20,21

Payments Intelligence Goes Artificial

Since 2020, the conversation around technological change in payments has largely focused on the rapid shift to ecommerce and its associated challenges. Those hurdles haven’t gone away; our panelists noted that digital transactions are viewed as riskier by the industry, attract new and higher fees, and often see a greater number of fraud attempts and chargebacks than in-store payments. Online shopping has also unlocked new customer experiences which have practical implications for settlement and fraud risk that payments managers must navigate to meet business demands.

But now, there’s a new elephant in the room when it comes to payments tech: Artificial Intelligence.

For many, it was the rise of OpenAI’s ChatGPT following its November 2022 launch which showed the true ability of AI and Large Language Models to transform everyday life. Our panel was confident that the technology would embed itself within payments in no time, with predictable applications across fraud, manual review processes, real-time transaction validation, and more. However, its nefarious potential was noted too, with fraudsters likely to outpace regulators – and perhaps some fraud solutions – as complexity compounds.

Fee Hikes Incoming

Unfortunately, in payments, some things never change. Merchants are anticipating the next set of updates to their card acceptance fees in January and April 2024, including new and increasing fees for accepting commercial cards, requesting a customer’s account name, excessive authorization attempts, and more.22 Panelists and CMSPI’s Chief Economist, Callum Godwin, noted that it is ultimately the merchants who understand the difference between non-negotiable, quasi-negotiable, and wholly negotiable costs (and their associated levers) that will be able to plug the gaps most effectively.

Knowledge is Power in 2024

Rising costs aren’t the only perennial truth that payments managers contend with in such a complex and rapidly changing sector. The other is the constant need for education; industry professionals today are required to be students, experts, and educators for stakeholders with the power to enact change both within and outside their organizations. In an industry like payments, that knowledge lies in data. Ultimately, it is a merchant’s visibility over that data – whether it’s transaction-level costs, AI-assisted fraud patterns, or policy impacts – that will allow them to stay optimal in 2024.

Sources

+1 Townhall Results | CMSPI Global

2 Recession Risk Is Rising, Economists Say – WSJ

3 US Recession Forecast Within Year Hits 100% in Blow to Biden Before Midterms – Bloomberg

4 Is the US heading for recession? All the indicators say yes | World Economic Forum (weforum.org)

5 What Is a Soft Landing? – Buy Side from WSJ

6 The US economy is on its final descent to a soft landing (goldmansachs.com)

7 Is A Recession Coming? – Forbes Advisor

8 2024 Economic Outlook: Insights & Trends | J.P. Morgan (jpmorgan.com)

9 About That Recession We Were All Bracing For… (msn.com)

10 ‘It’s lending on steroids’: How Buy Now, Pay Later companies are meeting an influx of demand despite higher costs | CNN Business

11 2024 Economic Outlook: Insights & Trends | J.P. Morgan (jpmorgan.com)

12 New Data: ‘Tis the season of the Lipstick Effect | Retail Bulletin (theretailbulletin.com)

13 With Recession Threatening, The Lipstick Effect Kicks In And Lipstick Sales Rise (forbes.com)

14 bowman-statement-20231025.pdf (federalreserve.gov)

15 NY governor pursues BNPL regulation | Payments Dive

16 Required Rulemaking on Personal Financial Data Rights | Consumer Financial Protection Bureau (consumerfinance.gov)

17 The $3 Billion PINless Routing Opportunity: Payments Profitability Redefined (cmspi.com)

18 Trade group girds for 2024 CCCA fight | Payments Dive

19 Marshall keeps up CCCA crusade | Payments Dive

20 CMSPI estimates and analysis

21 Credit Card Competition Act Could Result in Annual Savings Upward of $15 Billion | CMSPI Global

22 FIS Generic WithCover_Without footer (fisglobal.com))